infer

Infer conditional variances of conditional variance models

Description

Tbl2 = infer(Mdl,Tbl1)Tbl2 containing the inferred

conditional variances and innovations from evaluating the fully specified,

univariate conditional variance model Mdl at the response

variable data in the table or timetable Tbl1. When

Mdl is a model fitted to the response data and returned by

estimate, the inferred innovations are

residuals. (since R2023a)

infer selects the response variable named in

Mdl.SeriesName or the sole variable in

Tbl1. To select a different response variable in

Tbl1 at which to evaluate the model, use the

ResponseVariable name-value argument.

___

= infer(___,

specifies options using one or more name-value arguments in

addition to any of the input argument combinations in previous syntaxes.

Name,Value)infer returns the output argument combination for the

corresponding input arguments. For example, infer(Mdl,Y,V0=v0) initializes the

conditional variance model of Mdl using the presample

conditional variance data in v0.

Examples

Infer GARCH Model Conditional Variances From Numeric Response Data

Infer conditional variances from a GARCH(1,1) model with known coefficients. Specify response data as a numeric vector.

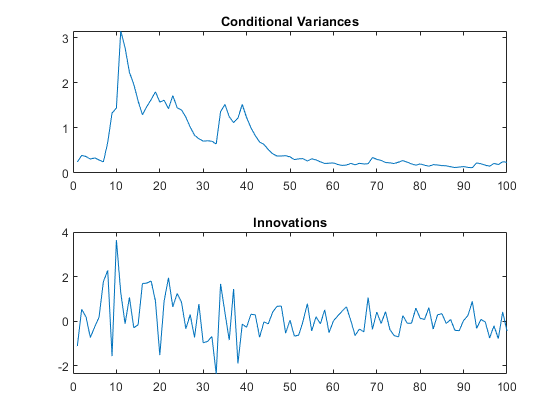

Specify a GARCH(1,1) model with known parameters. Simulate 101 conditional variances and responses (innovations) from the model. Set aside the first observation from each series to use as presample data.

Mdl = garch(Constant=0.01,GARCH=0.8,ARCH=0.15); rng("default") % For reproducibility [vS,yS] = simulate(Mdl,101); y0 = yS(1); v0 = vS(1); y = yS(2:end); v = vS(2:end); figure tiledlayout(2,1) nexttile plot(v) title("Conditional Variances") nexttile plot(y) title("Innovations")

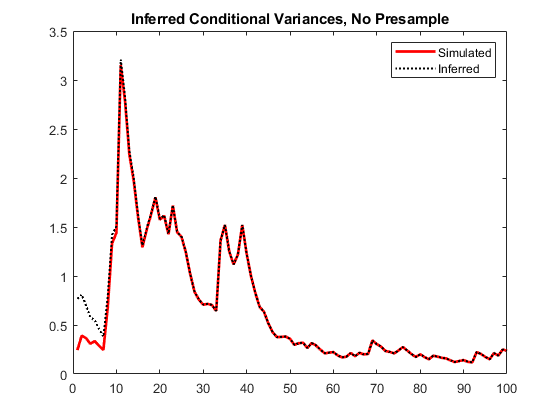

Infer the conditional variances of y without using presample data. Compare them to the known (simulated) conditional variances.

vI = infer(Mdl,y); figure plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vI,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, No Presample") hold off

Notice the transient response (discrepancy) in the early time periods due to the absence of presample data.

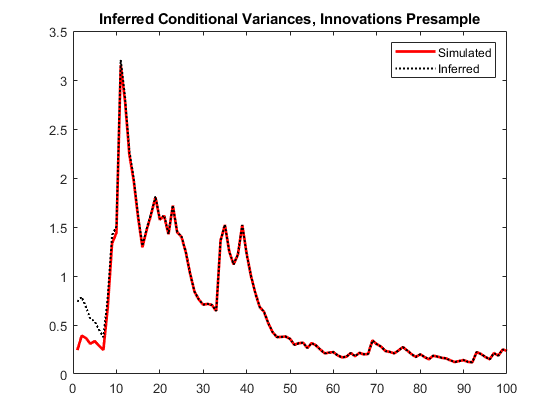

Infer conditional variances using the set-aside presample innovation, y0. Compare them to the known (simulated) conditional variances.

vE = infer(Mdl,y,E0=y0); figure plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vE,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, Innovations Presample") hold off

There is a slightly reduced transient response in the early time periods.

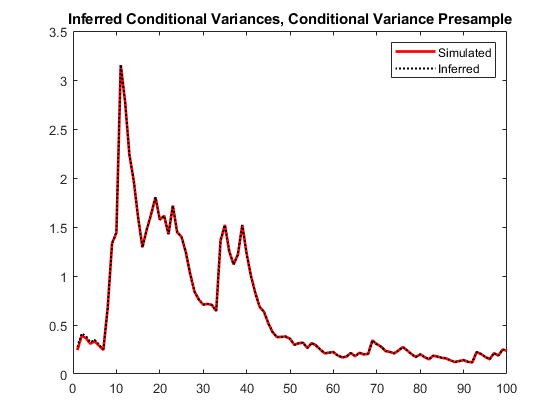

Infer conditional variances using the presample of conditional variance data, v0. Compare them to the known (simulated) conditional variances.

vO = infer(Mdl,y,V0=v0); figure plot(v) plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vO,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, Conditional Variance Presample") hold off

There is a much smaller transient response in the early time periods.

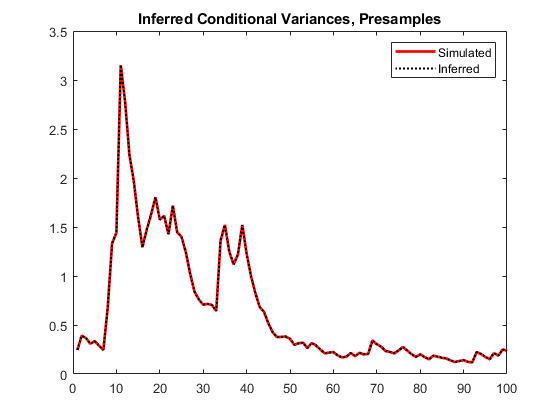

Infer conditional variances using both the presample innovation and conditional variance. Compare them to the known (simulated) conditional variances.

vEO = infer(Mdl,y,E0=y0,V0=v0); figure plot(v) plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vEO,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, Presamples") hold off

When you use sufficient presample innovations and conditional variances, the inferred conditional variances are exact (there is no transient response).

Infer EGARCH Model Conditional Variances

Infer conditional variances from an EGARCH(1,1) model with known coefficients. When you use, and then do not use presample data, compare the results from infer.

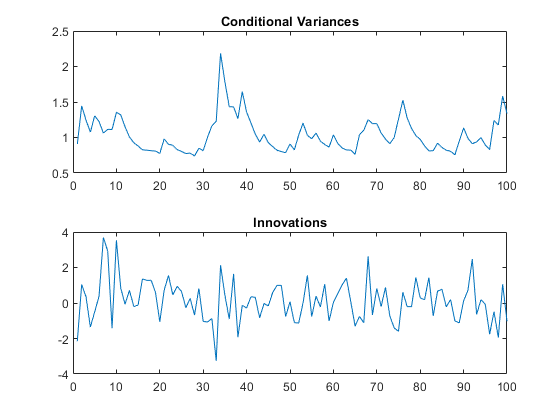

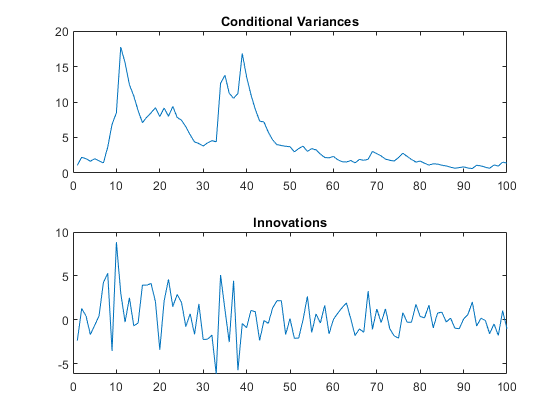

Specify an EGARCH(1,1) model with known parameters. Simulate 101 conditional variances and responses (innovations) from the model. Set aside the first observation from each series to use as presample data.

Mdl = egarch(Constant=0.001,GARCH=0.8, ... ARCH=0.15,Leverage=-0.1); rng("default") % For reproducibility [vS,yS] = simulate(Mdl,101); y0 = yS(1); v0 = vS(1); y = yS(2:end); v = vS(2:end); figure tiledlayout(2,1) nexttile plot(v) title("Conditional Variances") nexttile plot(y) title("Innovations")

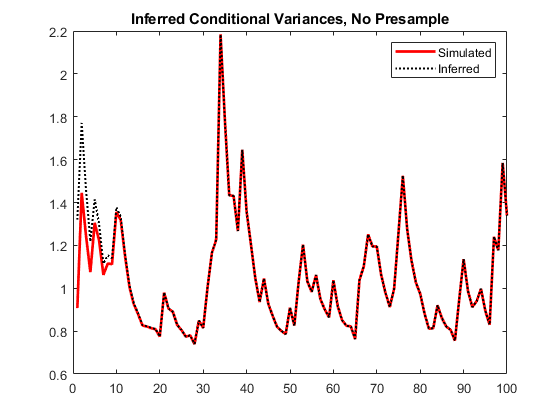

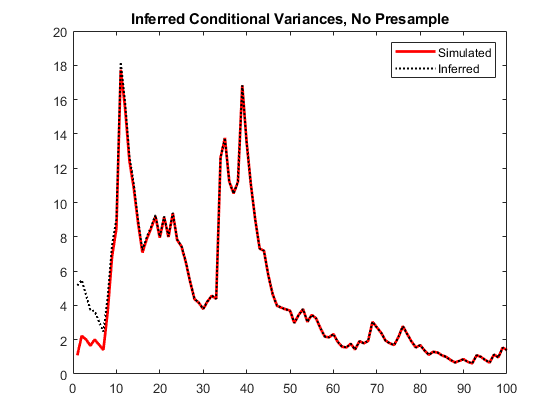

Infer the conditional variances of y without using any presample data. Compare them to the known (simulated) conditional variances.

vI = infer(Mdl,y); figure plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vI,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, No Presample") hold off

Notice the transient response (discrepancy) in the early time periods due to the absence of presample data.

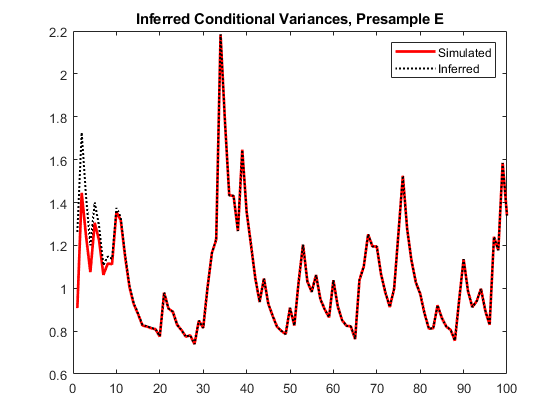

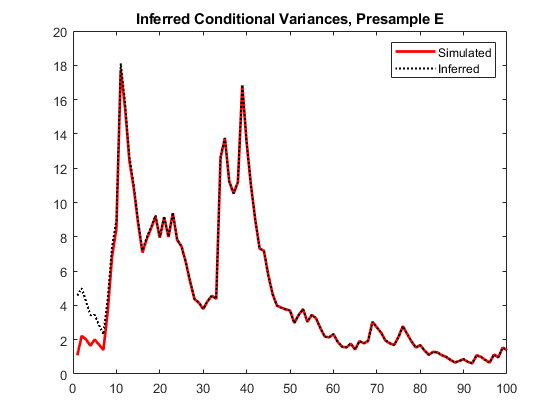

Infer conditional variances using the set-aside presample innovation, y0. Compare them to the known (simulated) conditional variances.

vE = infer(Mdl,y,E0=y0); figure plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vE,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, Presample E") hold off

There is a slightly reduced transient response in the early time periods.

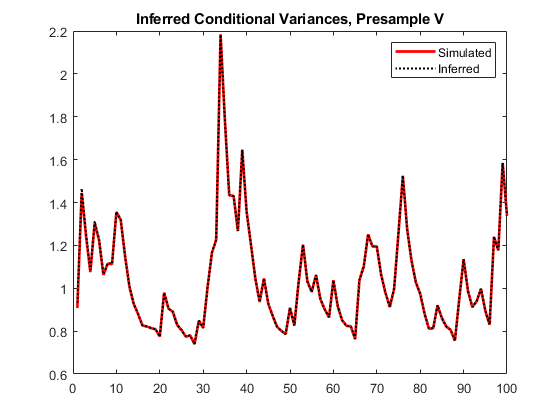

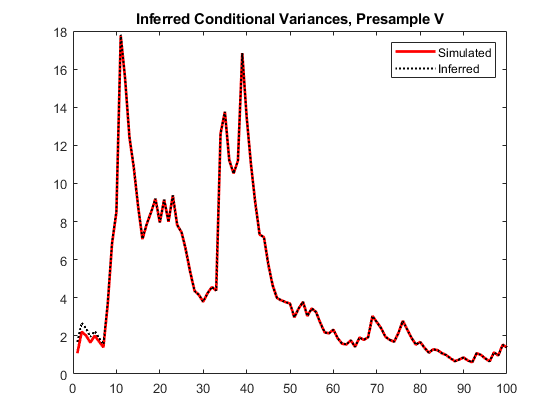

Infer conditional variances using the set-aside presample variance, v0. Compare them to the known (simulated) conditional variances.

vO = infer(Mdl,y,V0=v0); figure plot(v) plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vO,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, Presample V") hold off

The transient response is almost eliminated.

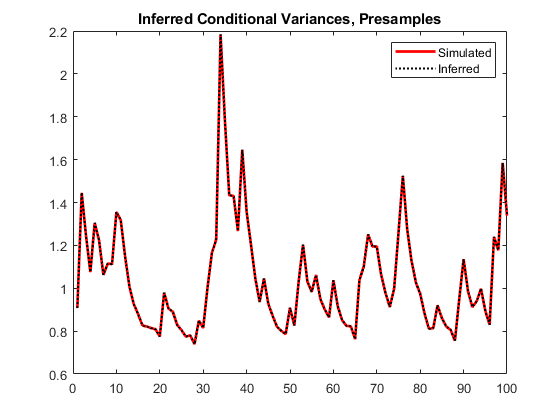

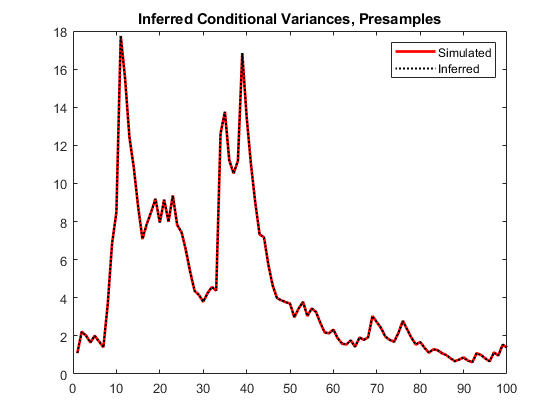

Infer conditional variances using both the presample innovation and conditional variance. Compare them to the known (simulated) conditional variances.

vEO = infer(Mdl,y,E0=y0,V0=v0); figure plot(v) plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vEO,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, Presamples") hold off

When you use sufficient presample innovations and conditional variances, the inferred conditional variances are exact (there is no transient response).

Infer GJR Model Conditional Variances

Infer conditional variances from a GJR(1,1) model with known coefficients. When you use, and then do not use presample data, compare the results from infer.

Specify a GJR(1,1) model with known parameters. Simulate 101 conditional variances and responses (innovations) from the model. Set aside the first observation from each series to use as presample data.

Mdl = gjr(Constant=0.01,GARCH=0.8,ARCH=0.14, ... Leverage=0.1); rng("default") % For reproducibility [vS,yS] = simulate(Mdl,101); y0 = yS(1); v0 = vS(1); y = yS(2:end); v = vS(2:end); figure tiledlayout(2,1) nexttile plot(v) title("Conditional Variances") nexttile plot(y) title("Innovations")

Infer the conditional variances of y without using any presample data. Compare them to the known (simulated) conditional variances.

vI = infer(Mdl,y); figure plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vI,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, No Presample") hold off

Notice the transient response (discrepancy) in the early time periods due to the absence of presample data.

Infer conditional variances using the set-aside presample innovation, y0. Compare them to the known (simulated) conditional variances.

vE = infer(Mdl,y,E0=y0); figure plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vE,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, Presample E") hold off

There is a slightly reduced transient response in the early time periods.

Infer conditional variances using the set-aside presample conditional variance, vO. Compare them to the known (simulated) conditional variances.

vO = infer(Mdl,y,V0=v0); figure plot(v) plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vO,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, Presample V") hold off

There is a much smaller transient response in the early time periods.

Infer conditional variances using both the presample innovation and conditional variance. Compare them to the known (simulated) conditional variances.

vEO = infer(Mdl,y,E0=y0,V0=v0); figure plot(v) plot(1:100,v,"r",LineWidth=2) hold on plot(1:100,vEO,"k:",LineWidth=1.5) legend("Simulated","Inferred",Location="northeast") title("Inferred Conditional Variances, Presamples") hold off

When you use sufficient presample innovations and conditional variances, the inferred conditional variances are exact (there is no transient response).

Conduct Likelihood Ratio Test for EGARCH Fit Comparison Specifying Data in Timetables

Since R2023a

Infer the loglikelihood objective function values for an EGARCH(1,1) and EGARCH(2,1) model fit to the average weekly closing NASDAQ returns. To identify which model is the more parsimonious, adequate fit, conduct a likelihood ratio test. Specify data in timetables.

Load the U.S. equity indices data Data_EquityIdx.mat.

load Data_EquityIdxThe timetable DataTimeTable contains the daily NASDAQ closing prices, among other indices.

Compute the weekly average closing prices of all timetable variables.

DTTW = convert2weekly(DataTimeTable,Aggregation="mean");Compute the weekly returns and their sample mean.

DTTRet = price2ret(DTTW); DTTRet.Interval = []; T = height(DTTRet)

T = 626

When you plan to supply a timetable, you must ensure it has all the following characteristics:

The selected response variable is numeric and does not contain any missing values.

The timestamps in the

Timevariable are regular, and they are ascending or descending.

Remove all missing values from the timetable, relative to the NASDAQ returns series.

DTTRet = rmmissing(DTTRet,DataVariables="NASDAQ");

numobs = height(DTTRet)numobs = 626

Because all sample times have observed NASDAQ returns, rmmissing does not remove any observations.

Determine whether the sampling timestamps have a regular frequency and are sorted.

areTimestampsRegular = isregular(DTTRet,"weeks")areTimestampsRegular = logical

1

areTimestampsSorted = issorted(DTTRet.Time)

areTimestampsSorted = logical

1

areTimestampsRegular = 1 indicates that the timestamps of DTTRet represent a regular weekly sample. areTimestampsSorted = 1 indicates that the timestamps are sorted.

Reserve the first two observations to use as a presample.

DTTRet0 = DTTRet(1:2,:); DTTRet = DTTRet(3:end,:);

Fit an EGARCH(1,1) model to the returns. Supply in-sample and presample data in timetables, and specify NASDAQ as the variable containing the presample innovations. Infer the loglikelihood objective function value.

MdlEGARCH11 = egarch(1,1); MdlEGARCH11.SeriesName = "NASDAQ"; EstMdlEGARCH11 = estimate(MdlEGARCH11,DTTRet, ... Presample=DTTRet0,PresampleInnovationVariable="NASDAQ");

EGARCH(1,1) Conditional Variance Model (Gaussian Distribution):

Value StandardError TStatistic PValue

________ _____________ __________ __________

Constant -0.48899 0.15218 -3.2133 0.0013123

GARCH{1} 0.95567 0.013348 71.598 0

ARCH{1} 0.2766 0.052276 5.2912 1.2154e-07

Leverage{1} -0.10593 0.025607 -4.1366 3.5244e-05

[TblEGARCH11,logLEGARCH11] = infer(EstMdlEGARCH11,DTTRet, ... Presample=DTTRet0,PresampleInnovationVariable="NASDAQ"); tail(TblEGARCH11)

Time NYSE NASDAQ NASDAQ_Variance NASDAQ_Residual

___________ ___________ ___________ _______________ _______________

16-Nov-2001 0.0021092 0.0048052 3.4439e-05 0.0048052

23-Nov-2001 0.001451 0.00085891 3.0717e-05 0.00085891

30-Nov-2001 -0.00039051 0.0020552 2.4587e-05 0.0020552

07-Dec-2001 0.00087108 0.005263 2.0775e-05 0.005263

14-Dec-2001 -0.002694 -0.0012244 2.0067e-05 -0.0012244

21-Dec-2001 0.0019929 -0.00094985 1.7698e-05 -0.00094985

28-Dec-2001 0.0019952 -4.93e-05 1.5413e-05 -4.93e-05

04-Jan-2002 -0.00011742 -0.0012263 1.2447e-05 -0.0012263

TblEGARCH11 is a timetable of NASDAQ residuals NASDAQ_Residual and conditional variances NASDAQ_Variance, and all variables in the specified in-sample data DTTRet. logLEGARCH11 is the loglikelihood of the estimated model EstMdlEGARCH11 evaluated at the specified presample and in-sample data.

Fit an EGARCH(2,1) model to the returns. Supply in-sample and presample data in timetables, and specify NASDAQ as the variable containing the presample innovations. Infer the loglikelihood objective function value.

MdlEGARCH21 = egarch(2,1); MdlEGARCH21.SeriesName = "NASDAQ"; EstMdlEGARCH21 = estimate(MdlEGARCH21,DTTRet, ... Presample=DTTRet0,PresampleInnovationVariable="NASDAQ");

EGARCH(2,1) Conditional Variance Model (Gaussian Distribution):

Value StandardError TStatistic PValue

_________ _____________ __________ __________

Constant -0.48641 0.15765 -3.0854 0.002033

GARCH{1} 0.96882 0.27062 3.58 0.00034361

GARCH{2} -0.012906 0.26607 -0.048505 0.96131

ARCH{1} 0.27422 0.074054 3.7029 0.00021312

Leverage{1} -0.10486 0.035239 -2.9756 0.002924

[TblEGARCH21,logLEGARCH21] = infer(EstMdlEGARCH21,DTTRet, ... Presample=DTTRet0,PresampleInnovationVariable="NASDAQ");

Conduct a likelihood ratio test, with the more parsimonious EGARCH(1,1) model as the null model, and the EGARCH(2,1) model as the alternative. The degree of freedom for the test is 1, because the EGARCH(2,1) model has one more parameter than the EGARCH(1,1) model (an additional GARCH term).

[h,p] = lratiotest(logLEGARCH21,logLEGARCH11,1)

h = logical

0

p = 0.9565

The null hypothesis is not rejected (h = 0). At the 0.05 significance level, the EGARCH(1,1) model is not rejected in favor of the EGARCH(2,1) model.

Conduct Likelihood Ratio Test for GARCH and GJR Fit Comparison

A GARCH(P, Q) model is nested within a GJR(P, Q) model. Therefore, you can perform a likelihood ratio test to compare GARCH(P, Q) and GJR(P, Q) model fits.

Infer the loglikelihood objective function values for a GARCH(1,1) and GJR(1,1) model fit to NASDAQ Composite Index returns. Conduct a likelihood ratio test to identify which model is the more parsimonious, adequate fit.

Load the NASDAQ data included with the toolbox, and convert the index to returns. Set aside the first two observations to use as presample data.

load Data_EquityIdx

nasdaq = DataTable.NASDAQ;

r = price2ret(nasdaq);

r0 = r(1:2);

rn = r(3:end);Fit a GARCH(1,1) model to the returns, and infer the loglikelihood objective function value.

Mdl1 = garch(1,1); EstMdl1 = estimate(Mdl1,rn,E0=r0);

GARCH(1,1) Conditional Variance Model (Gaussian Distribution):

Value StandardError TStatistic PValue

_________ _____________ __________ __________

Constant 2.005e-06 5.4298e-07 3.6926 0.00022197

GARCH{1} 0.88333 0.0084536 104.49 0

ARCH{1} 0.10924 0.0076666 14.249 4.5739e-46

[~,logL1] = infer(EstMdl1,rn,E0=r0);

Fit a GJR(1,1) model to the returns, and infer the loglikelihood objective function value.

Mdl2 = gjr(1,1); EstMdl2 = estimate(Mdl2,rn,E0=r0);

GJR(1,1) Conditional Variance Model (Gaussian Distribution):

Value StandardError TStatistic PValue

__________ _____________ __________ __________

Constant 2.4754e-06 5.6986e-07 4.3439 1.3997e-05

GARCH{1} 0.88101 0.0095108 92.632 0

ARCH{1} 0.064017 0.0091852 6.9696 3.1794e-12

Leverage{1} 0.089301 0.0099215 9.0007 2.2429e-19

[~,logL2] = infer(EstMdl2,rn,E0=r0);

Conduct a likelihood ratio test, with the more parsimonious GARCH(1,1) model as the null model, and the GJR(1,1) model as the alternative. The degree of freedom for the test is 1, because the GJR(1,1) model has one more parameter than the GARCH(1,1) model (a leverage term).

[h,p] = lratiotest(logL2,logL1,1)

h = logical

1

p = 4.5815e-10

The null hypothesis is rejected (h = 1). At the 0.05 significance level, the GARCH(1,1) model is rejected in favor of the GJR(1,1) model.

Input Arguments

Y — Response data

numeric column vector | numeric matrix

Response data, specified as a numobs-by-1 numeric

column vector or numobs-by-numpaths

matrix.

As a column vector, Y represents a single path of the

underlying series.

As a matrix, the rows of Y correspond to periods and

the columns correspond to separate paths. The observations across any row

occur simultaneously.

infer infers the conditional variances of

Y. Y usually represents an

innovation series with mean 0 and variances characterized by

Mdl. It is the continuation of the presample

innovation series E0. Y can also

represent a time series of innovations with mean 0 plus an offset. If

Mdl has a nonzero offset, then the software stores

its value in the Offset property

(Mdl.Offset).

The last observation of any series is the latest observation.

Tbl1 — Time series data

table | timetable

Since R2023a

Time series data containing response variable

yt, at which

infer evaluates the conditional variance

model Mdl, specified as a table or timetable with

numvars variables and numobs rows.

You can optionally select a response variable by using the

ResponseVariable name-value argument.

The selected variable is a single path (numobs-by-1

vector) or multiple paths

(numobs-by-numpaths matrix) of

numobs observations of response data. Each row is an

observation, and measurements in each row occur simultaneously.

The selected response variable in Tbl1 is a

numobs-by-numpaths numeric matrix.

Each row is an observation, and measurements in each row occur

simultaneously.

Each path (column) of the selected variable is independent of the other paths.

If Tbl1 is a timetable, it must represent a sample

with a regular datetime time step (see isregular), and the datetime

vector Tbl1.Time must be strictly ascending or

descending.

If Tbl1 is a table, the last row contains the latest

observation.

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: 'E0',[1 1;0.5 0.5],'V0',[1 0.5;1 0.5] specifies two

equivalent presample paths of innovations and two, different presample paths of

conditional variances.

ResponseVariable — Variable to select from Tbl1 to treat as response variable yt

string scalar | character vector | integer | logical vector

Since R2023a

Variable to select from Tbl1 to treat as the response variable

yt, specified as one of the following

data types:

String scalar or character vector containing a variable name in

Tbl1.Properties.VariableNamesVariable index (integer) to select from

Tbl1.Properties.VariableNamesA length

numvarslogical vector, whereResponseVariable(selects variablej) = truejTbl1.Properties.VariableNames, andsum(ResponseVariable)is1

The selected variable must be a numeric vector and cannot contain missing values (NaN).

If Tbl1 has one variable, the default specifies that variable. Otherwise, the default matches the variable to name in Mdl.SeriesName.

Example: ResponseVariable="StockRate2"

Example: ResponseVariable=[false false true false] or ResponseVariable=3 selects the third table variable as the response variable.

Data Types: double | logical | char | cell | string

E0 — Presample innovation paths εt

numeric column vector | numeric matrix

Presample innovation paths

εt, specified as a

numpreobs-by-1 numeric column vector or a

numpreobs-by-numprepaths

matrix. The presample innovations provide initial values for the

innovations process of the conditional variance model

Mdl, and derive from a distribution with mean

0. Use E0 only when you supply the numeric array of

response data Y.

numpreobs is the number of presample observations.

numprepaths is the number of presample response

paths.

Each row is a presample observation, and measurements in each row

occur simultaneously. The last row contains the latest presample

observation. numpreobs must be at least

Mdl.Q. If numpreobs >

Mdl.Q, infer uses the

latest required number of observations only. The last element or row

contains the latest observation.

If

E0is a column vector, it represents a single path of the underlying innovation series.inferapplies it to each output path.If

E0is a matrix, each column represents a presample path of the underlying innovation series.numprepathsmust be at leastnumpaths. Ifnumprepaths>numpaths,inferuses the firstsize(Y,2)columns only.

The defaults are:

For GARCH(P,Q) and GJR(P,Q) models,

infersets any necessary presample innovations to the square root of the average squared value of the offset-adjusted response seriesY.For EGARCH(P,Q) models,

infersets any necessary presample innovations to zero.

Data Types: double

V0 — Positive presample conditional variance paths σt2

positive column vector | positive matrix

Positive presample conditional variance paths

σt2,

specified as a numpreobs-by-1 positive column vector

or numpreobs-by-numprepaths

positive matrix. V0 provides initial values for the

conditional variances in the model. Use V0 only when

you supply the numeric array of disturbances

Z.

Each row is a presample observation, and measurements in each row occur simultaneously. The last row contains the latest presample observation.

For GARCH(P,Q) and GJR(P,Q) models,

numpreobsmust be at leastMdl.P.For EGARCH(P,Q) models,

numpreobsmust be at leastmax([Mdl.P Mdl.Q]).

numpreobs must be at least

max([Mdl.P Mdl.Q]). If

numpreobs > max([Mdl.P

Mdl.Q]), infer uses the latest

required number of observations only. The last element or row contains

the latest observation.

If

V0is a column vector, it represents a single path of the conditional variance series.inferapplies it to each output path.If

V0is a matrix, each column represents a presample path of the conditional variance series.numprepathsmust be at leastnumpaths. Ifnumprepaths>numpaths,inferuses the firstsize(Y,2)columns only.

By default, infer sets any necessary

presample conditional variances to the unconditional variance of the

process.

Data Types: double

Presample — Presample data

table | timetable

Since R2023a

Presample data containing paths of innovation

εt or conditional

variance

σt2

series to initialize the model, specified as a table or timetable, the

same type as Tbl1, with

numprevars variables and

numpreobs rows. Use

Presample only when you supply a table or

timetable of data Tbl1.

Each selected variable is a single path

(numpreobs-by-1 vector) or multiple paths

(numpreobs-by-numprepaths

matrix) of numpreobs observations representing the

presample of numpreobs observations of the innovation

or conditional variance series for

ResponseVariable, the selected response variable in

Tbl1.

Each row is a presample observation, and measurements in each row

occur simultaneously. numpreobs must be one of the

following values:

Mdl.QwhenPresampleprovides only presample innovations.Mdl.PwhenPresampleprovides only presample conditional variances.max([Mdl.P Mdl.Q])whenPresampleprovides both presample innovations and conditional variances

If numpreobs exceeds the minimum

number, infer uses the latest required number

of observations only.

If Presample is a timetable, all the following

conditions must be true:

Presamplemust represent a sample with a regular datetime time step (seeisregular).The inputs

Tbl1andPresamplemust be consistent in time such thatPresampleimmediately precedesTbl1with respect to the sampling frequency and order.The datetime vector of sample timestamps

Presample.Timemust be ascending or descending.

If Presample is a table, the last row contains

the latest presample observation.

The defaults are:

For GARCH(P,Q) and GJR(P,Q) models,

infersets any necessary presample innovations to the square root of the average squared value of the offset-adjusted response seriesY.For EGARCH(P,Q) models,

infersets any necessary presample innovations to zero.infersets any necessary presample conditional variances to the unconditional variance of the process.

If you specify the Presample, you must specify

the presample innovation or conditional variance variable names by using

the PresampleInnovationVariable or

PresampleVarianceVariable name-value

argument.

PresampleInnovationVariable — Variable of Presample containing presample innovation paths εt

string scalar | character vector | integer | logical vector

Since R2023a

Variable of Presample containing presample innovation paths εt, specified as one of the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (integer) to select from

Presample.Properties.VariableNamesA length

numprevarslogical vector, wherePresampleInnovationVariable(selects variablej) = truejPresample.Properties.VariableNames, andsum(PresampleInnovationVariable)is1

The selected variable must be a numeric matrix and cannot contain missing values (NaN).

If you specify presample innovation data by using the Presample name-value argument, you must specify PresampleInnovationVariable.

Example: PresampleInnovationVariable="StockRateInnov0"

Example: PresampleInnovationVariable=[false false true false] or PresampleInnovationVariable=3 selects the third table variable as the presample innovation variable.

Data Types: double | logical | char | cell | string

PresampleVarianceVariable — Variable of Presample containing data for the presample conditional variances σt2

string scalar | character vector | integer | logical vector

Since R2023a

Variable of Presample containing data for the presample conditional

variances

σt2,

specified as one of the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (positive integer) to select from

Presample.Properties.VariableNamesA logical vector, where

PresampleVarianceVariable(selects variablej) = truejPresample.Properties.VariableNames

The selected variable must be a numeric vector and cannot contain missing values

(NaNs).

If you specify presample conditional variance data by using the Presample name-value argument, you must specify PresampleVarianceVariable.

Example: PresampleVarianceVariable="StockRateVar0"

Example: PresampleVarianceVariable=[false false true false] or PresampleVarianceVariable=3 selects the third table variable as the presample conditional variance variable.

Data Types: double | logical | char | cell | string

Notes:

NaNvalues inY,E0, andV0indicate missing values.inferremoves missing values from specified data by list-wise deletion.For the presample,

inferhorizontally concatenatesE0andV0, and then it removes any row of the concatenated matrix containing at least oneNaN.For in-sample data

Y,inferremoves any row containing at least oneNaN.

This type of data reduction reduces the effective sample size and can create an irregular time series.

For numeric data inputs,

inferassumes that you synchronize the presample data such that the latest observations occur simultaneously.inferissues an error when any table or timetable input contains missing values.

Output Arguments

V — Conditional variances

numeric column vector | numeric matrix

Conditional variances inferred from the response data

Y, returned as a numeric column vector or matrix.

infer returns V only

when you supply the input Y.

The dimensions of V and Y are

equivalent. If Y is a matrix, then the columns of

V are the inferred conditional variance paths

corresponding to the columns of Y.

Rows of V are periods corresponding to the periodicity

of Y.

logL — Loglikelihood objective function values

numeric scalar | numeric vector

Tbl2 — Inferred conditional variance σt2 and

innovation εt paths

table | timetable

Since R2023b

Inferred conditional variance

σt2

and innovation εt paths, returned

as a table or timetable, the same data type as Tbl1.

infer returns Tbl2 only

when you supply the input Tbl1. When

Mdl is an estimated model returned by

estimate, the returned, inferred innovations are

residuals.

Tbl2 contains the following variables:

The inferred conditional variance paths, which are in a

numobs-by-numpathsnumeric matrix, with rows representing observations and columns representing independent paths. Each path represents the continuation of the corresponding path of presample conditional variances inPresample.infernames the filtered conditional variance variable inTbl2responseName_VarianceresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisStockReturns,Tbl2contains a variable for the corresponding inferred conditional variance paths with the nameStockReturns_Variance.The inferred innovation paths, which are in a

numobs-by-numpathsnumeric matrix, with rows representing observations and columns representing independent paths. Each path corresponds to the input response path inTbl1and represents the continuation of the corresponding presample innovations path inPresample.infernames the inferred innovations variable inTbl2responseName_ResidualresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisStockReturns,Tbl2contains a variable for the corresponding inferred innovations paths with the nameStockReturns_Residual.All variables

Tbl1.

If Tbl1 is a timetable, row times of

Tbl1 and Tbl2 are

equal.

Algorithms

If you do not specify presample data (E0 and

V0, or Presample),

infer derives the necessary presample observations from

the unconditional, or long-run, variance of the offset-adjusted response process.

For all conditional variance model types, required presample conditional variances are the sample average of the squared disturbances of the offset-adjusted specified response data (

YorTbl1).For GARCH(P,Q) and GJR(P,Q) models, the required presample innovations are the square root of the average squared value of the offset-adjusted response data.

For EGARCH(P,Q) models, the required presample innovaitons are

0.

These specifications minimize initial transient effects.

References

[1] Bollerslev, T. “Generalized Autoregressive Conditional Heteroskedasticity.” Journal of Econometrics. Vol. 31, 1986, pp. 307–327.

[2] Bollerslev, T. “A Conditionally Heteroskedastic Time Series Model for Speculative Prices and Rates of Return.” The Review of Economics and Statistics. Vol. 69, 1987, pp. 542–547.

[3] Box, G. E. P., G. M. Jenkins, and G. C. Reinsel. Time Series Analysis: Forecasting and Control. 3rd ed. Englewood Cliffs, NJ: Prentice Hall, 1994.

[4] Enders, W. Applied Econometric Time Series. Hoboken, NJ: John Wiley & Sons, 1995.

[5] Engle, R. F. “Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of United Kingdom Inflation.” Econometrica. Vol. 50, 1982, pp. 987–1007.

[6] Glosten, L. R., R. Jagannathan, and D. E. Runkle. “On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks.” The Journal of Finance. Vol. 48, No. 5, 1993, pp. 1779–1801.

[7] Hamilton, J. D. Time Series Analysis. Princeton, NJ: Princeton University Press, 1994.

Version History

Introduced in R2012aR2023a: infer accepts input data in tables and timetables, and returns results in tables and timetables

In addition to accepting input data (in-sample and presample) in numeric arrays,

infer accepts input data in tables or regular

timetables. When you supply data in a table or timetable, the following conditions

apply:

inferchooses the default in-sample response series on which to operate, but you can use the specified optional name-value argument to select a different series.If you specify optional presample innovation or conditional variance data to initialize the model, you must also specify the presample innovation or conditional variance series name.

inferreturns results in a table or timetable.

Name-value arguments to support tabular workflows include:

ResponseVariablespecifies the variable name of the response paths in the input data, from whichinferinfers conditional variances and innovations.Presamplespecifies the input table or timetable of presample innovation and conditional variance data.PresampleInnovationVariablespecifies the variable name of the innovation paths to select fromPresample.PresampleVarianceVariablespecifies the variable name of the conditional variance paths to select fromPresample.

See Also

Objects

Functions

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list:

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)