Simulate Conditional Variance Model

This example shows how to simulate a conditional variance model using simulate.

Step 1. Load the data and specify the model.

Load the Deutschmark/British pound foreign exchange rate data included with the toolbox, and convert to returns. Specify and fit a GARCH(1,1) model.

load Data_MarkPound

r = price2ret(Data);

T = length(r);

Mdl = garch(1,1);

EstMdl = estimate(Mdl,r);

GARCH(1,1) Conditional Variance Model (Gaussian Distribution):

Value StandardError TStatistic PValue

__________ _____________ __________ __________

Constant 1.0538e-06 3.5052e-07 3.0062 0.0026452

GARCH{1} 0.80654 0.012913 62.462 0

ARCH{1} 0.15438 0.011577 13.335 1.4436e-40

v0 = infer(EstMdl,r);

Step 2. Simulate foreign exchange rate returns.

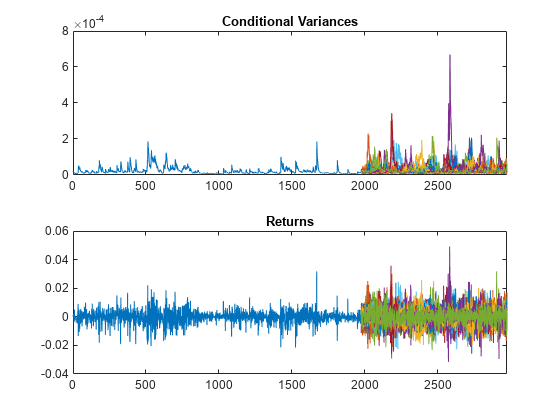

Use the fitted model to simulate 25 realizations of foreign exchange rate returns and conditional variances over a 1000-period forecast horizon. Use the observed returns and inferred conditional variances as presample innovations and variances, respectively.

rng default; % For reproducibility [V,Y] = simulate(EstMdl,1000,'NumPaths',25,... 'E0',r,'V0',v0); figure subplot(2,1,1) plot(v0) hold on plot(T+1:T+1000,V) xlim([0,T+1000]) title('Conditional Variances') hold off subplot(2,1,2) plot(r) hold on plot(T+1:T+1000,Y) xlim([0,T+1000]) title('Returns') hold off

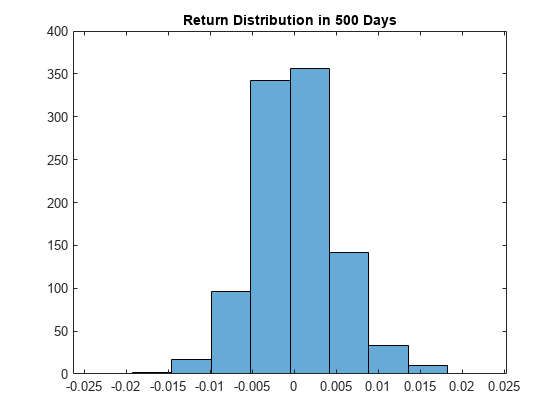

Step 3. Plot the returns distribution at a future time.

Use simulations to generate a forecast distribution of foreign exchange returns 500 days into the future. Generate 1000 sample paths to estimate the distribution.

rng default; % For reproducibility [V,Y] = simulate(EstMdl,500,'NumPaths',1000,... 'E0',r-EstMdl.Offset,'V0',v0); figure histogram(Y(500,:),10) title('Return Distribution in 500 Days')

See Also

Objects

Functions

Related Examples

- Specify Conditional Variance Model for Exchange Rates

- Likelihood Ratio Test for Conditional Variance Models

- Forecast a Conditional Variance Model