Portfolio Optimization and Asset Allocation

Quantitative investment managers and risk managers use portfolio optimization to choose the proportions of various assets to be held in a portfolio. The goal of portfolio optimization is to maximize a measure or proxy for a portfolio's return contingent on a measure or proxy for a portfolio’s risk. This toolbox provides a comprehensive suite of portfolio optimization and analysis tools for performing capital allocation, asset allocation, and risk assessment using mean-variance, Conditional Value-at-Risk (CVaR), Mean-Absolute Deviation (MAD), and custom portfolio optimizations. In addition, the toolbox provides a backtesting framework to backtest portfolio allocation strategies and performance attribution functions for single periods, over relatively short time spans, or multiple periods.

Frequently Viewed Topics

- Portfolio Optimization Theory

- Portfolio Object

- Portfolio Object Workflow

- PortfolioCVaR Object

- PortfolioCVaR Object Workflow

- PortfolioMAD Object

- PortfolioMAD Object Workflow

- Black-Litterman Portfolio Optimization Using Financial Toolbox

- When to Use Portfolio Objects Over Optimization Toolbox

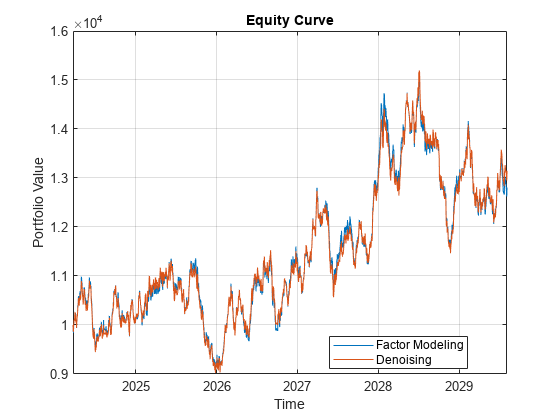

- Portfolio Optimization Using Factor Models

- Asset Allocation Case Study

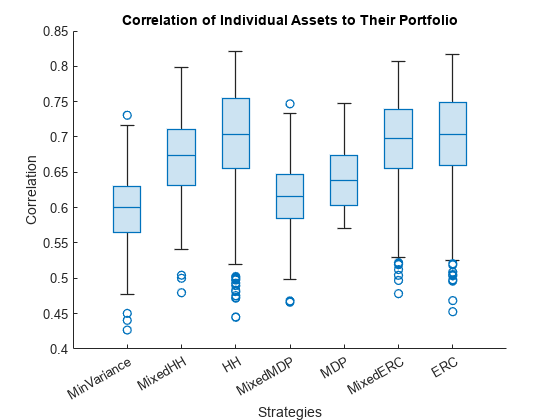

- Risk Budgeting Portfolio

- Solve Problem for Minimum Tracking Error with Net Return Constraint

- Solve Robust Portfolio Maximum Return Problem with Ellipsoidal Uncertainty

- Hedging Using CVaR Portfolio Optimization

- Compute Maximum Reward-to-Risk Ratio for CVaR Portfolio

- Backtest with Brinson Attribution to Evaluate Portfolio Performance

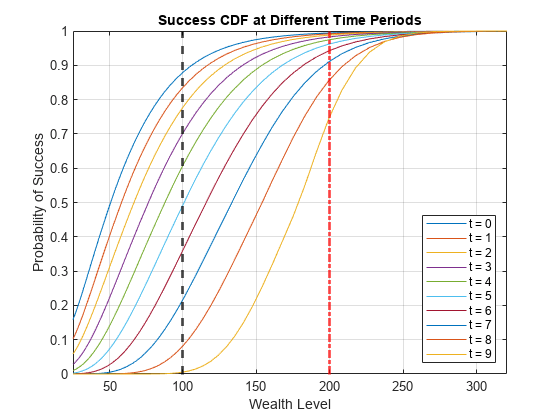

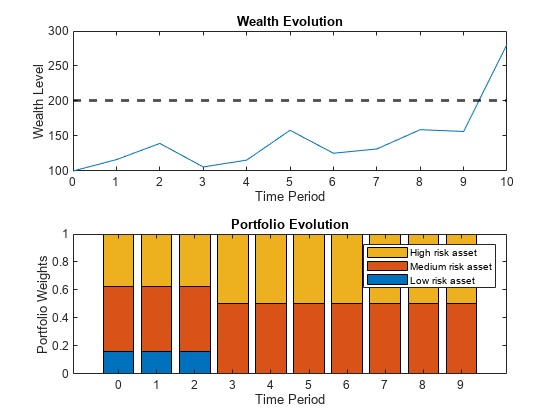

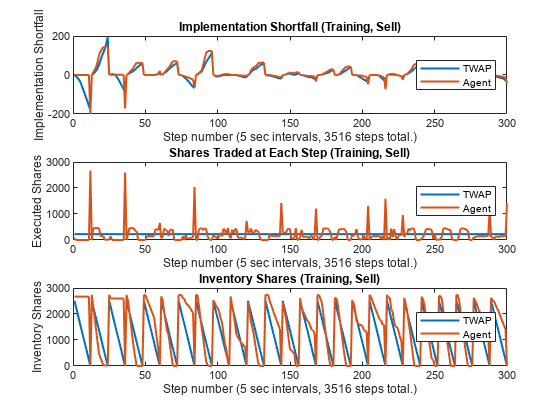

- Multiperiod Goal-Based Wealth Management Using Reinforcement Learning

- Choose MINLP Solvers for Portfolio Problems

- Troubleshooting Portfolio Optimization Results

Categories

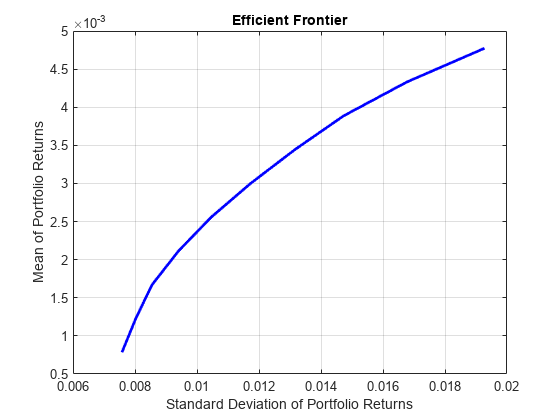

- Portfolio Optimization Theory

Background theory for Portfolio optimization problems

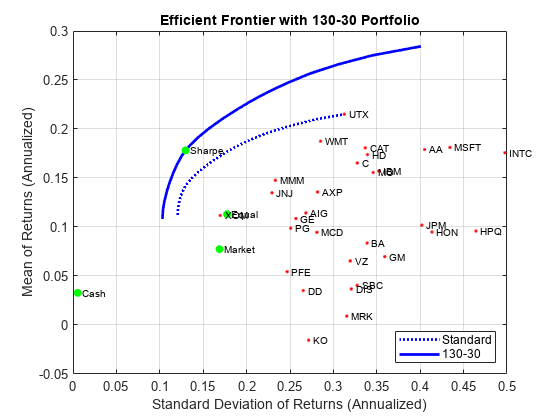

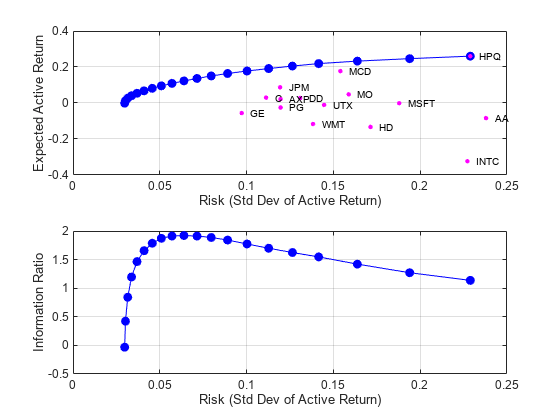

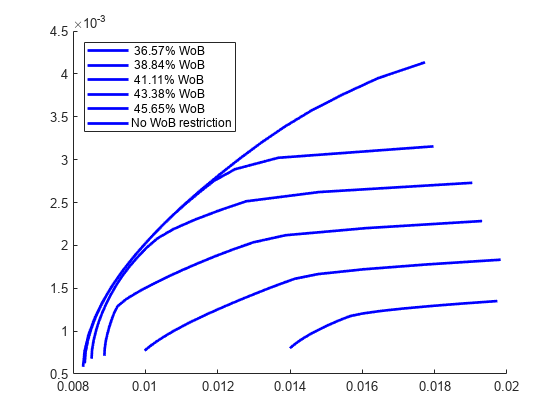

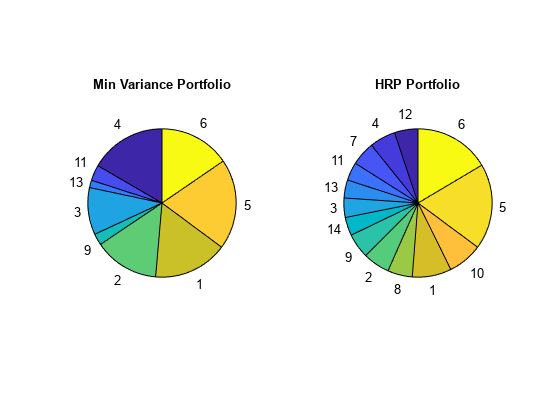

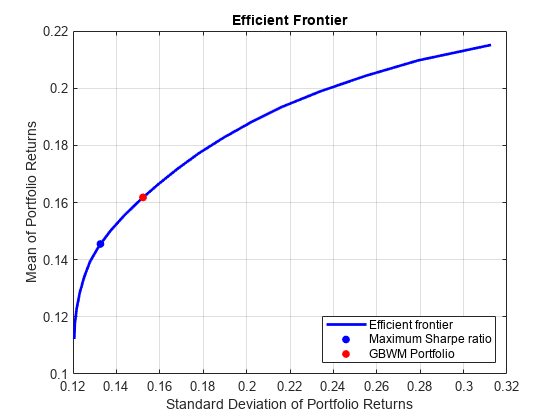

- Mean-Variance Portfolio Optimization

Create Portfolio object, evaluate composition of assets, perform mean-variance portfolio optimization

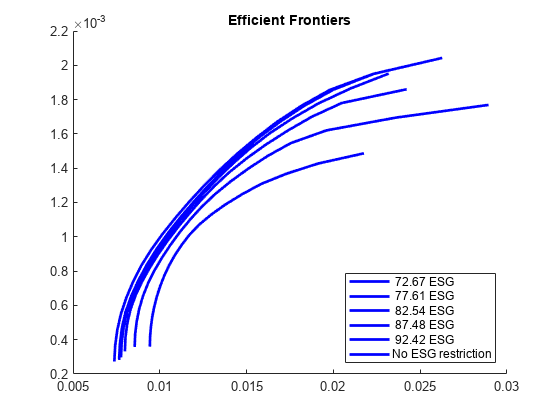

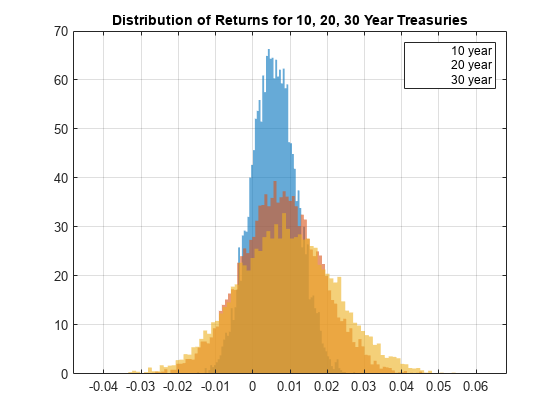

- Conditional Value-at-Risk Portfolio Optimization

Create PortfolioCVaR object, evaluate composition of assets, perform CVaR portfolio optimization

- Mean-Absolute Deviation Portfolio Optimization

Create PortfolioMAD object, evaluate composition of assets, perform MAD portfolio optimization

- Custom Portfolio Optimization

Estimate optimal portfolio, specify user-defined objective function, define constraints

- Portfolio Analysis

Analyze portfolio for returns variance and covariance, simulate correlation of assets, calculate portfolio value at risk (VaR)

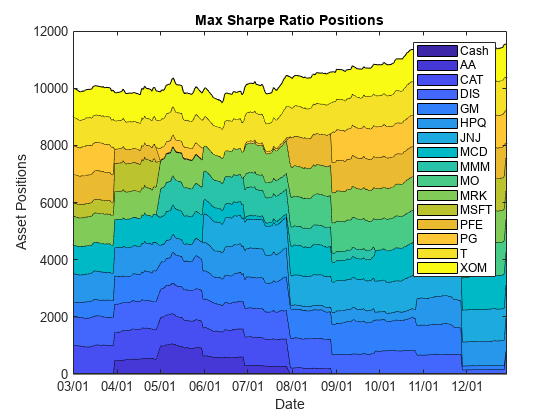

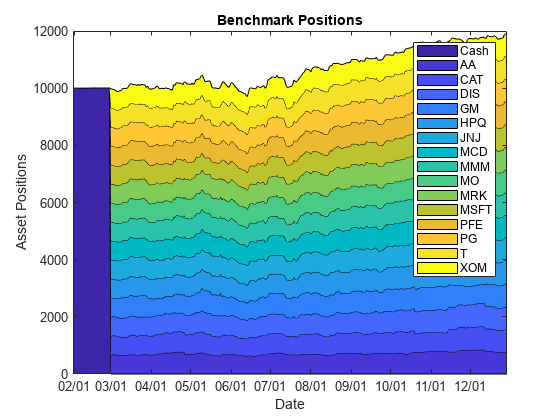

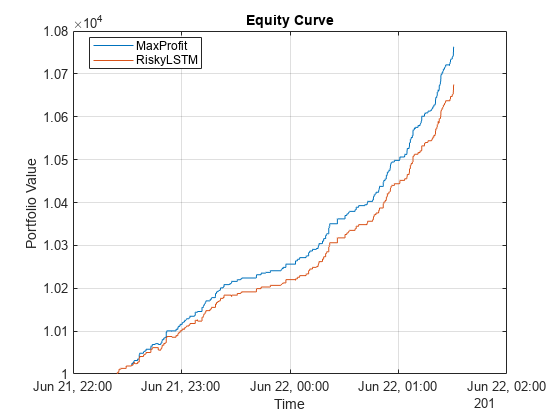

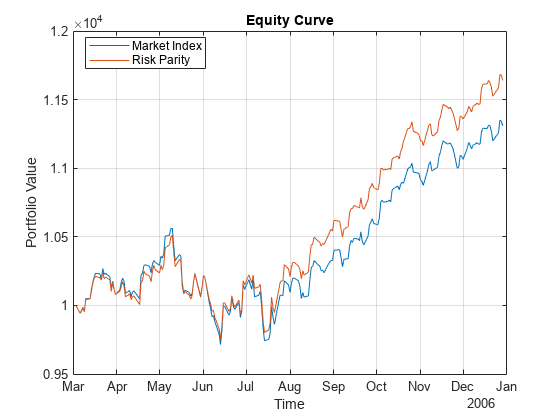

- Backtest Framework

Define investment strategies, run backtests, analyze strategy performance

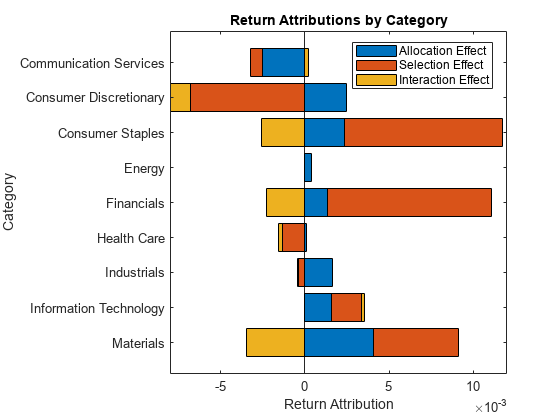

- Performance Attribution

Compute and analyze performance attribution using the Brinson model