bininfo

Return predictor’s bin information

Syntax

Description

bi = bininfo(sc,PredictorName)PredictorName.

bi = bininfo(___,Name,Value)

[

adds optional name-value arguments.bi,bm]

= bininfo(sc,PredictorName,Name,Value)bininfo also optionally

returns the binning map (bm) or bin rules in the form of a

vector of cut points for numeric predictors, or a table of category groupings

for categorical predictors.

[

returns information at bin level, such as frequencies of “Good,”

“Bad," and bin statistics for the predictor specified in

bi,bm,mv]

= bininfo(sc,PredictorName,Name,Value)PredictorName using optional name-value pair arguments.

bininfo optionally returns the binning map or bin rules

in the form of a vector of cut points for numeric predictors, or a table of

category groupings for categorical predictors. In addition, optional name-value

pair arguments mv returns a numeric array containing the

minimum and maximum values, as set (or defined) by the user. The

mv output argument is set to an empty array for

categorical predictors.

Examples

Display Bin Information Using Default Options

Create a creditscorecard object using the CreditCardData.mat file to load the data (using a dataset from Refaat 2011).

load CreditCardData

sc = creditscorecard(data);Display bin information for the categorical predictor ResStatus.

bi = bininfo(sc,'ResStatus')bi=4×6 table

Bin Good Bad Odds WOE InfoValue

______________ ____ ___ ______ _________ _________

{'Home Owner'} 365 177 2.0621 0.019329 0.0001682

{'Tenant' } 307 167 1.8383 -0.095564 0.0036638

{'Other' } 131 53 2.4717 0.20049 0.0059418

{'Totals' } 803 397 2.0227 NaN 0.0097738

Display Bin Information For a creditscorecard Object Containing Weights

Use the CreditCardData.mat file to load the data (dataWeights) that contains a column (RowWeights) for the weights (using a dataset from Refaat 2011).

load CreditCardDataCreate a creditscorecard object using the optional name-value pair argument for 'WeightsVar'.

sc = creditscorecard(dataWeights,'WeightsVar','RowWeights')

sc =

creditscorecard with properties:

GoodLabel: 0

ResponseVar: 'status'

WeightsVar: 'RowWeights'

VarNames: {'CustID' 'CustAge' 'TmAtAddress' 'ResStatus' 'EmpStatus' 'CustIncome' 'TmWBank' 'OtherCC' 'AMBalance' 'UtilRate' 'RowWeights' 'status'}

NumericPredictors: {'CustID' 'CustAge' 'TmAtAddress' 'CustIncome' 'TmWBank' 'AMBalance' 'UtilRate'}

CategoricalPredictors: {'ResStatus' 'EmpStatus' 'OtherCC'}

BinMissingData: 0

IDVar: ''

PredictorVars: {'CustID' 'CustAge' 'TmAtAddress' 'ResStatus' 'EmpStatus' 'CustIncome' 'TmWBank' 'OtherCC' 'AMBalance' 'UtilRate'}

Data: [1200x12 table]

Display bin information for the numerical predictor 'CustIncome'. When the optional name-value pair argument 'WeightsVar' is used to specify observation (sample) weights, the bi table contains weighted counts.

bi = bininfo(sc,'CustIncome');

bi(1:10,:)ans=10×6 table

Bin Good Bad Odds WOE InfoValue

_________ _______ _______ _______ ________ __________

{'18000'} 0.94515 1.496 0.63179 -1.1667 0.0059198

{'19000'} 0.47588 0.80569 0.59065 -1.2341 0.0034716

{'20000'} 2.1671 1.4636 1.4806 -0.31509 0.00061392

{'21000'} 3.2522 0.88064 3.693 0.59889 0.0021303

{'22000'} 1.5438 1.2714 1.2142 -0.51346 0.0012913

{'23000'} 1.787 2.7529 0.64913 -1.1397 0.010509

{'24000'} 3.4111 2.2538 1.5135 -0.29311 0.00082663

{'25000'} 2.2333 6.1383 0.36383 -1.7186 0.042642

{'26000'} 2.1246 4.4754 0.47474 -1.4525 0.024526

{'27000'} 3.1058 3.528 0.88032 -0.83501 0.0082144

Display Bin Information Using Name-Value Arguments

Create a creditscorecard object using the CreditCardData.mat file to load the data (using a dataset from Refaat 2011).

load CreditCardData

sc = creditscorecard(data);Display customized bin information for the categorical predictor ResStatus, keeping only the WOE column. The Weight-of-Evidence (WOE) is defined bin by bin, but there is no concept of "total WOE", therefore the last element in the 'Totals' row is set to NaN.

bi = bininfo(sc,'ResStatus','Statistics','WOE'); disp(bi)

Bin Good Bad WOE

______________ ____ ___ _________

{'Home Owner'} 365 177 0.019329

{'Tenant' } 307 167 -0.095564

{'Other' } 131 53 0.20049

{'Totals' } 803 397 NaN

Display customized bin information for the categorical predictor ResStatus, keeping only the Odds and WOE columns, without the Totals row.

bi = bininfo(sc,'ResStatus','Statistics',{'Odds','WOE'},'Totals','Off'); disp(bi)

Bin Good Bad Odds WOE

______________ ____ ___ ______ _________

{'Home Owner'} 365 177 2.0621 0.019329

{'Tenant' } 307 167 1.8383 -0.095564

{'Other' } 131 53 2.4717 0.20049

Display information value, entropy, Gini, and chi square statistics. For more information on these statistics, see Statistics for a Credit Scorecard.

For information value, entropy and Gini, the value reported at a bin level is the contribution of the bin to the total value. The total information value, entropy, and Gini measures are in the 'Totals' row.

For chi square, if there are N bins, the first N-1 values in the 'Chi2' column report pairwise chi square statistics for contiguous bins. For example, this pairwise measure is also used by the 'Merge' algorithm in autobinning to determine if two contiguous bins should be merged. In this example, the first value in the 'Chi2' column (1.0331) is the chi square statistic of bins 1 and 2 ('Home Owner' and 'Tenant'), and the second value in the column (2.5103) is the chi square statistic of bins 2 and 3 ('Tenant' and 'Other'). There are no more pairwise chi square values to compute in this example, so the third element of the 'Chi2' column is set to NaN. The chi square value reported in the 'Totals' row is the chi square statistic computed over all bins.

bi = bininfo(sc,'ResStatus','Statistics',{'InfoValue','Entropy','Gini','Chi2'}); disp(bi)

Bin Good Bad InfoValue Entropy Gini Chi2

______________ ____ ___ _________ _______ _______ ______

{'Home Owner'} 365 177 0.0001682 0.91138 0.43984 1.0331

{'Tenant' } 307 167 0.0036638 0.93612 0.45638 2.5103

{'Other' } 131 53 0.0059418 0.86618 0.41015 NaN

{'Totals' } 803 397 0.0097738 0.91422 0.44182 2.5549

Display Bin Information and Binning Map for Categorical Data

Create a creditscorecard object using the CreditCardData.mat file to load the data (using a dataset from Refaat 2011).

load CreditCardData

sc = creditscorecard(data);The binning map or rules for categorical data are summarized in a "category grouping" table, returned as an optional output. By default, each category is placed in a separate bin. Here is the information for the predictor ResStatus.

[bi,cg] = bininfo(sc,'ResStatus')bi=4×6 table

Bin Good Bad Odds WOE InfoValue

______________ ____ ___ ______ _________ _________

{'Home Owner'} 365 177 2.0621 0.019329 0.0001682

{'Tenant' } 307 167 1.8383 -0.095564 0.0036638

{'Other' } 131 53 2.4717 0.20049 0.0059418

{'Totals' } 803 397 2.0227 NaN 0.0097738

cg=3×2 table

Category BinNumber

______________ _________

{'Home Owner'} 1

{'Tenant' } 2

{'Other' } 3

To group categories Tenant and Other, modify the category grouping table cg so that the bin number for Other is the same as the bin number for Tenant. Then use the modifybins function to update the scorecard.

cg.BinNumber(3) = 2; sc = modifybins(sc,'ResStatus','CatGrouping',cg);

Display the updated bin information. The bin labels have been updated and that the bin membership information is contained in the category grouping cg.

[bi,cg] = bininfo(sc,'ResStatus')bi=3×6 table

Bin Good Bad Odds WOE InfoValue

__________ ____ ___ ______ _________ __________

{'Group1'} 365 177 2.0621 0.019329 0.0001682

{'Group2'} 438 220 1.9909 -0.015827 0.00013772

{'Totals'} 803 397 2.0227 NaN 0.00030592

cg=3×2 table

Category BinNumber

______________ _________

{'Home Owner'} 1

{'Tenant' } 2

{'Other' } 2

Display Bin Information and Binning Map for Numeric Data

Create a creditscorecard object using the CreditCardData.mat file to load the data (using a dataset from Refaat 2011).

load CreditCardData

sc = creditscorecard(data);The predictor CustIncome is numeric. By default, each value of the predictor is placed in a separate bin.

bi = bininfo(sc,'CustIncome')bi=46×6 table

Bin Good Bad Odds WOE InfoValue

_________ ____ ___ _______ _________ __________

{'18000'} 2 3 0.66667 -1.1099 0.0056227

{'19000'} 1 2 0.5 -1.3976 0.0053002

{'20000'} 4 2 2 -0.011271 6.3641e-07

{'21000'} 6 3 2 -0.011271 9.5462e-07

{'22000'} 4 2 2 -0.011271 6.3641e-07

{'23000'} 4 4 1 -0.70442 0.0035885

{'24000'} 5 5 1 -0.70442 0.0044856

{'25000'} 4 9 0.44444 -1.5153 0.026805

{'26000'} 4 11 0.36364 -1.716 0.038999

{'27000'} 6 6 1 -0.70442 0.0053827

{'28000'} 13 11 1.1818 -0.53736 0.0061896

{'29000'} 11 10 1.1 -0.60911 0.0069988

{'30000'} 18 16 1.125 -0.58664 0.010493

{'31000'} 24 8 3 0.39419 0.0038382

{'32000'} 21 15 1.4 -0.36795 0.0042797

{'33000'} 35 19 1.8421 -0.093509 0.00039951

⋮

Reduce the number of bins using the autobinning function (the modifybins function can also be used).

sc = autobinning(sc,'CustIncome');Display the updated bin information. The binning map or rules for numeric data are summarized as "cut points," returned as an optional output (cp).

[bi,cp] = bininfo(sc,'CustIncome')bi=8×6 table

Bin Good Bad Odds WOE InfoValue

_________________ ____ ___ _______ _________ __________

{'[-Inf,29000)' } 53 58 0.91379 -0.79457 0.06364

{'[29000,33000)'} 74 49 1.5102 -0.29217 0.0091366

{'[33000,35000)'} 68 36 1.8889 -0.06843 0.00041042

{'[35000,40000)'} 193 98 1.9694 -0.026696 0.00017359

{'[40000,42000)'} 68 34 2 -0.011271 1.0819e-05

{'[42000,47000)'} 164 66 2.4848 0.20579 0.0078175

{'[47000,Inf]' } 183 56 3.2679 0.47972 0.041657

{'Totals' } 803 397 2.0227 NaN 0.12285

cp = 6×1

29000

33000

35000

40000

42000

47000

Manually remove the second cut point (the boundary between the second and third bins) to merge bins two and three. Use the modifybins function to update the scorecard.

cp(2) = []; sc = modifybins(sc,'CustIncome','CutPoints',cp,'MinValue',0);

Display the updated bin information.

[bi,cp,mv] = bininfo(sc,'CustIncome')bi=7×6 table

Bin Good Bad Odds WOE InfoValue

_________________ ____ ___ _______ _________ __________

{'[0,29000)' } 53 58 0.91379 -0.79457 0.06364

{'[29000,35000)'} 142 85 1.6706 -0.19124 0.0071274

{'[35000,40000)'} 193 98 1.9694 -0.026696 0.00017359

{'[40000,42000)'} 68 34 2 -0.011271 1.0819e-05

{'[42000,47000)'} 164 66 2.4848 0.20579 0.0078175

{'[47000,Inf]' } 183 56 3.2679 0.47972 0.041657

{'Totals' } 803 397 2.0227 NaN 0.12043

cp = 5×1

29000

35000

40000

42000

47000

mv = 1×2

0 Inf

Note, it is recommended to avoid having bins with frequencies of zero because they lead to infinite or undefined (NaN) statistics. Use the modifybins or autobinning functions to modify bins.

Display Bin Information for Missing Data

Create a creditscorecard object using the CreditCardData.mat file to load the dataMissing with missing values.

load CreditCardData.mat

head(dataMissing,5) CustID CustAge TmAtAddress ResStatus EmpStatus CustIncome TmWBank OtherCC AMBalance UtilRate status

______ _______ ___________ ___________ _________ __________ _______ _______ _________ ________ ______

1 53 62 <undefined> Unknown 50000 55 Yes 1055.9 0.22 0

2 61 22 Home Owner Employed 52000 25 Yes 1161.6 0.24 0

3 47 30 Tenant Employed 37000 61 No 877.23 0.29 0

4 NaN 75 Home Owner Employed 53000 20 Yes 157.37 0.08 0

5 68 56 Home Owner Employed 53000 14 Yes 561.84 0.11 0

fprintf('Number of rows: %d\n',height(dataMissing))Number of rows: 1200

fprintf('Number of missing values CustAge: %d\n',sum(ismissing(dataMissing.CustAge)))Number of missing values CustAge: 30

fprintf('Number of missing values ResStatus: %d\n',sum(ismissing(dataMissing.ResStatus)))Number of missing values ResStatus: 40

Use creditscorecard with the name-value argument 'BinMissingData' set to true to bin the missing data in a separate bin.

sc = creditscorecard(dataMissing,'IDVar','CustID','BinMissingData',true); sc = autobinning(sc); disp(sc)

creditscorecard with properties:

GoodLabel: 0

ResponseVar: 'status'

WeightsVar: ''

VarNames: {'CustID' 'CustAge' 'TmAtAddress' 'ResStatus' 'EmpStatus' 'CustIncome' 'TmWBank' 'OtherCC' 'AMBalance' 'UtilRate' 'status'}

NumericPredictors: {'CustAge' 'TmAtAddress' 'CustIncome' 'TmWBank' 'AMBalance' 'UtilRate'}

CategoricalPredictors: {'ResStatus' 'EmpStatus' 'OtherCC'}

BinMissingData: 1

IDVar: 'CustID'

PredictorVars: {'CustAge' 'TmAtAddress' 'ResStatus' 'EmpStatus' 'CustIncome' 'TmWBank' 'OtherCC' 'AMBalance' 'UtilRate'}

Data: [1200x11 table]

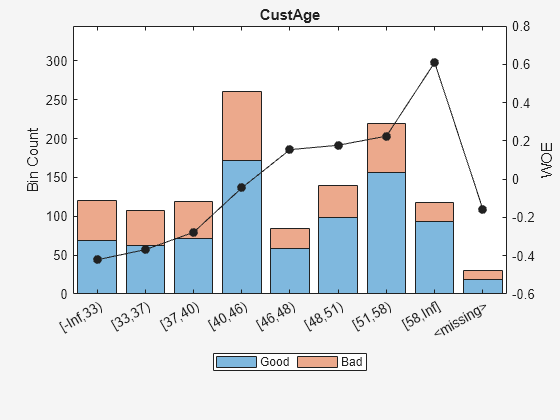

Display bin information for numeric data for 'CustAge' that includes missing data in a separate bin labelled <missing>.

bi = bininfo(sc,'CustAge');

disp(bi) Bin Good Bad Odds WOE InfoValue

_____________ ____ ___ ______ ________ __________

{'[-Inf,33)'} 69 52 1.3269 -0.42156 0.018993

{'[33,37)' } 63 45 1.4 -0.36795 0.012839

{'[37,40)' } 72 47 1.5319 -0.2779 0.0079824

{'[40,46)' } 172 89 1.9326 -0.04556 0.0004549

{'[46,48)' } 59 25 2.36 0.15424 0.0016199

{'[48,51)' } 99 41 2.4146 0.17713 0.0035449

{'[51,58)' } 157 62 2.5323 0.22469 0.0088407

{'[58,Inf]' } 93 25 3.72 0.60931 0.032198

{'<missing>'} 19 11 1.7273 -0.15787 0.00063885

{'Totals' } 803 397 2.0227 NaN 0.087112

plotbins(sc,'CustAge')

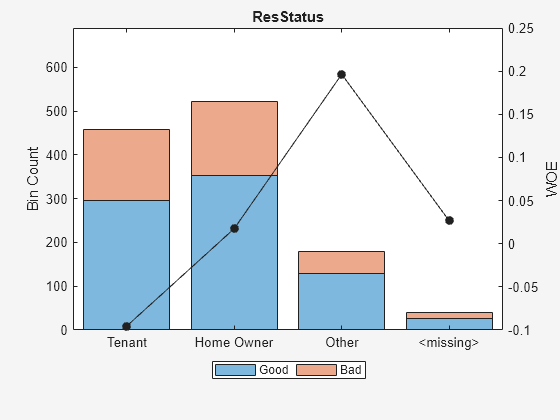

Display bin information for categorical data for 'ResStatus' that includes missing data in a separate bin labelled <missing>.

[bi,cg] = bininfo(sc,'ResStatus');

disp(bi) Bin Good Bad Odds WOE InfoValue

______________ ____ ___ ______ _________ __________

{'Tenant' } 296 161 1.8385 -0.095463 0.0035249

{'Home Owner'} 352 171 2.0585 0.017549 0.00013382

{'Other' } 128 52 2.4615 0.19637 0.0055808

{'<missing>' } 27 13 2.0769 0.026469 2.3248e-05

{'Totals' } 803 397 2.0227 NaN 0.0092627

disp(cg)

Category BinNumber

______________ _________

{'Tenant' } 1

{'Home Owner'} 2

{'Other' } 3

Note that the category grouping table does not include <missing> because this is a reserved bin and users cannot interact directly with the <missing> bin.

plotbins(sc,'ResStatus')

Input Arguments

sc — Credit scorecard model

creditscorecard object

Credit scorecard model, specified as a

creditscorecard object. Use creditscorecard to create

a creditscorecard object.

PredictorName — Predictor name

character vector

Predictor name, specified using a character vector containing the name

of the predictor. PredictorName is

case-sensitive.

Data Types: char

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: bi = bininfo(sc,

PredictorName,'Statistics','WOE','Totals','On')

Statistics — List of statistics to include for bin information

{'Odds','WOE','InfoValue'} (default) | character vector with values 'Odds',

'WOE',

'InfoValue','Entropy',

'Gini', 'Chi2' | cell array of character vectors with values

'Odds', 'WOE',

'InfoValue',

'Entropy','Gini',

'Chi2'

List of statistics to include in the bin information, specified as

the comma-separated pair consisting of 'Statistics'

and a character vector or a cell array of character vectors. For more

information, see Statistics for a Credit Scorecard. Possible values are:

'Odds'— Odds information is the ratio of “Goods” over “Bads.”'WOE'— Weight of Evidence. The WOE Statistic measures the deviation between the distribution of “Goods” and “Bads.”'InfoValue'— Information value. Closely tied to the WOE, it is a statistic used to determine how strong a predictor is to use in the fitting model. It measures how strong the deviation is between the distributions of “Goods” and “Bads.” However, bins with only “Good” or only “Bad” observations do lead to an infinite Information Value. Consider modifying the bins in those cases by usingmodifybinsorautobinning.'Entropy'— Entropy is a measure of unpredictability contained in the bins. The more the number of “Goods” and “Bads” differ within the bins, the lower the entropy.'Gini'— Measure of statistical dispersion or inequality within a sample of data.'Chi2'— Measure of statistical difference and independence between groups.

Note

Avoid having bins with frequencies of zero because they lead

to infinite or undefined (NaN) statistics.

Use modifybins or

autobinning to

modify bins.

Data Types: char | cell

Totals — Indicator to include row of totals at bottom information table

'On'

(default) | character vector with values 'On',

'Off'

Indicator to include a row of totals at the bottom of the

information table, specified as the comma-separated pair consisting of

'Totals' and a character vector with values

On or Off.

Data Types: char

Output Arguments

bi — Bin information

table

Bin information, returned as a table. The bin information table

contains one row per bin and a row of totals. The columns contain bin

descriptions, frequencies of “Good” and “Bad,”

and bin statistics. Avoid having bins with frequencies of zero because they

lead to infinite or undefined (NaN) statistics. Use

modifybins or autobinning to modify bins.

Note

When creating the creditscorecard object with

creditscorecard, if

the optional name-value pair argument WeightsVar

was used to specify observation (sample) weights, then the

bi table contains weighted counts.

bm — Binning map or rules

vector of cut points for numeric predictors | table of category groupings for categorical predictors

Binning map or rules, returned as a vector of cut points for numeric

predictors, or a table of category groupings for categorical predictors.

For more information, see modifybins.

mv — Binning minimum and maximum values

numeric array

Binning minimum and maximum values (as set or defined by the user),

returned as a numeric array. The mv output argument

is set to an empty array for categorical predictors.

More About

Statistics for a Credit Scorecard

Weight of Evidence (WOE) is a measure of the difference of the distribution of “Goods” and “Bads” within a bin.

Suppose the predictor's data takes on M possible values b1, ..., bM. For binned data, M is a small number. The response takes on two values, “Good” and “Bad.” The frequency table of the data is given by:

| Good | Bad | Total | |

|---|---|---|---|

| b1: | n11 | n12 | n1 |

| b2: | n21 | n22 | n2 |

| bM: | nM1 | nM2 | nM |

| Total: | nGood | nBad | nTotal |

The Weight of Evidence (WOE) is defined for each data value

bi as

WOE(i) = log((ni1/nGood)/(ni2/nBad)).

If you define

pGood(i) = ni1/nGood, pBad(i) = ni2/nBad

then pGood(i) is the proportion of

“Good” observations that take on the value bi,

and similarly for pBad(i). In other words,

pGood(i) gives the distribution of

good observations over the M observed values of the

predictor, and similarly for pBad(i). With

this, an equivalent formula for the WOE

is

WOE(i) = log(pGood(i)/pBad(i)).

Odds(i) = ni1 / ni2,

OddsTotal = nGood / nBad.

For each row i, you can also compute its contribution to the total Information Value, given by

InfoValue(i) = (pGood(i) - pBad(i)) * WOE(i),

and the total Information Value is simply the sum of all the

InfoValuel(i) terms. (A

nansum is returned to discard contributions from rows

with no observations at all.)

Likewise, for each row i, we can compute its contribution to the total Entropy, given by

Entropy(i) = -1/log(2)*(ni1/ni*log(ni1/ni)+ni2/ni*log(ni2/ni),

Entropy = sum(ni/nTotal * Entropy(i)), i = 1...M.

Chi2 is computed pairwise for each pair of bins and measures the statistical difference between two groups when splitting or merging bins and is defined as:

Chi2 = sum(sum((Aij - Eij)^2/Eij , j=1..k), i=m,m+1).

Gini ratio is a measure of the parent node, that is, of the given bins/categories prior to splitting or merging. The Gini ratio is defined as:

Gr = 1-G_hat/Gp

G_hat is

the weighted Gini measure for the current split or

merge:G_hat = Sum((nj/N) * Gj, j=1..m).

Using bininfo with Weights

When observation weights are defined using the optional

WeightsVar argument when creating a

creditscorecard object, instead of counting the rows that

are good or bad in each bin, the bininfo function accumulates

the weight of the rows that are good or bad in each bin.

The “frequencies” reported are no longer the basic “count” of rows, but the

“cumulative weight” of the rows that are good or bad and fall in a particular

bin. Once these “weighted frequencies” are known, all other relevant statistics

(Good, Bad, Odds,

WOE, and InfoValue) are computed with

the usual formulas. For more information, see Credit Scorecard Modeling Using Observation Weights.

References

[1] Anderson, R. The Credit Scoring Toolkit. Oxford University Press, 2007.

[2] Refaat, M. Credit Risk Scorecards: Development and Implementation Using SAS. lulu.com, 2011.

Version History

Introduced in R2014b

See Also

creditscorecard | autobinning | predictorinfo | modifypredictor | modifybins | bindata | plotbins | fitmodel | displaypoints | formatpoints | score | setmodel | probdefault | validatemodel

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list:

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)