stochosc

Stochastic oscillator

Description

percentKnD = stochosc(Data)

percentKnD = stochosc(___,Name,Value)

Examples

Calculate the Stochastic Oscillator for a Stock

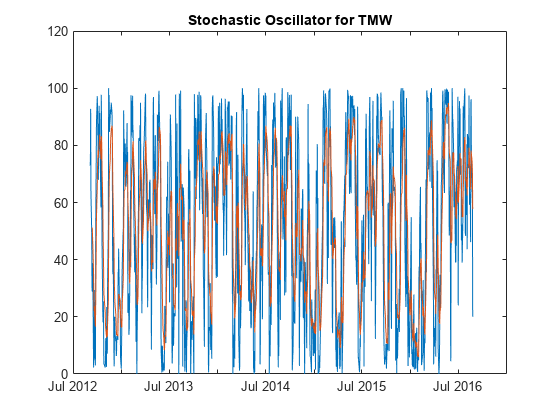

Load the file SimulatedStock.mat, which provides a timetable (TMW) for financial data for TMW stock.

load SimulatedStock.mat oscillator = stochosc(TMW,'NumPeriodsD',7,'NumPeriodsK',10,'Type','exponential'); plot(oscillator.Time,oscillator.FastPercentK,oscillator.Time,oscillator.FastPercentD) title('Stochastic Oscillator for TMW')

Input Arguments

Data — Data with high, low, open, close information

matrix | table | timetable

Data with high, low, open, close information, specified as a matrix,

table, or timetable. For matrix input, Data is an

M-by-3 matrix of high, low, and

closing prices stored in the corresponding columns, respectively. Timetables

and tables with M rows must contain variables named

'High', 'Low', and

'Close' (case insensitive).

Data Types: double | table | timetable

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: percentKnD =

stochosc(TMW,'NumPeriodsD',10,'NumPeriodsK',3,'Type','exponential')

NumPeriodsK — Period difference for PercentK

10

(default) | positive integer

Period difference for PercentK, specified as the comma-separated pair

consisting of 'NumPeriodsK' and a scalar positive

integer.

Data Types: double

NumPeriodsD — Length of moving average in periods for PercentD

3

(default) | positive integer

Length of moving average in periods for PercentD, specified as the

comma-separated pair consisting of 'NumPeriodsD' and

a scalar positive integer.

Data Types: double

Type — Moving average method for PercentD calculation

'e' (exponential) (default) | character vector with values 'exponential' or

'triangular'

Moving average method for PercentD calculation, specified as the

comma-separated pair consisting of 'Type' and a

character vector with a value of:

'exponential'– Exponential moving average is a weighted moving average. Exponential moving averages reduce the lag by applying more weight to recent prices. For example, a 10 period exponential moving average weights the most recent price by 18.18%.'triangular'– Triangular moving average is a double-smoothing of the data. The first simple moving average is calculated and then a second simple moving average is calculated on the first moving average with the same window size.

Data Types: char

Output Arguments

percentKnD — PercentK and PercentD

matrix | table | timetable

PercentK and PercentD, returned with the same number of rows

(M) and type (matrix, table, or timetable) as the

input Data.

More About

Stochastic Oscillator

The stochastic oscillator calculates the Fast PercentK (F%K), Fast PercentD (F%D), Slow PercentK (S%K), and Slow PercentD (S%D) from the series of high, low, and closing stock prices.

By default, the stochastic oscillator is based on 10-period difference for PercentK and a 3-period exponential moving average for PercentD.

References

[1] Achelis, S. B. Technical Analysis from A to Z. Second Edition. McGraw-Hill, 1995, pp. 268–271.

Version History

Introduced before R2006aR2023a: fints support removed for Data input argument

fints object support for the Data input

argument is removed.

R2022b: Support for negative price data

The Data input accepts negative prices.

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list:

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)