bktree

Build Black-Karasinski interest-rate tree

Description

Examples

Input Arguments

Output Arguments

References

[1] Hull, J., and A. White. "Using Hull-White Interest Rate Trees." Journal of Derivatives. 1996.

[2] Hull, J., and A. White. "The General Hull-White Model and Super Calibration." August 2000.

Version History

Introduced before R2006a

See Also

bkprice | bkvolspec | bktimespec | intenvset | bksens

Topics

- Pricing Using Interest-Rate Tree Models

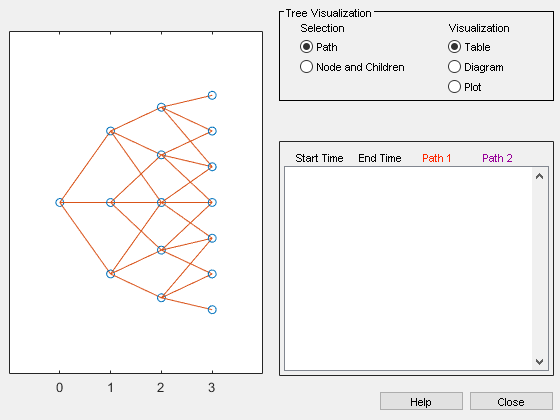

- Use treeviewer to Examine HWTree and PriceTree When Pricing European Callable Bond

- Calibrating Hull-White Model Using Market Data

- Pricing Options Structure

- Understanding Interest-Rate Tree Models

- Supported Interest-Rate Instrument Functions

- Mapping Financial Instruments Toolbox Functions for Interest-Rate Instrument Objects