Analyzing Investment Strategies with CVaR Portfolio Optimization

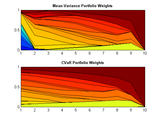

A .zip file contains a series of scripts that were used in the MathWorks webinar "Analyzing Investment Strategies with CVaR Portfolio Optimization in MATLAB." The scripts demonstrate features of the PortfolioCVaR and Portfolio objects for normative analysis of a covered-call strategy. A readme.txt. file in the .zip folder describes how to use the scripts.

Cite As

Bob Taylor (2024). Analyzing Investment Strategies with CVaR Portfolio Optimization (https://www.mathworks.com/matlabcentral/fileexchange/39449-analyzing-investment-strategies-with-cvar-portfolio-optimization), MATLAB Central File Exchange. Retrieved .

MATLAB Release Compatibility

Platform Compatibility

Windows macOS LinuxCategories

Tags

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Discover Live Editor

Create scripts with code, output, and formatted text in a single executable document.