Datafeed Toolbox provides access to financial data, news data, and trading systems. You can establish connections from MATLAB to retrieve historical, intraday, or real-time data streams and then perform analyses, develop models and financial trading strategies, and create visualizations that reflect financial and market behavior.

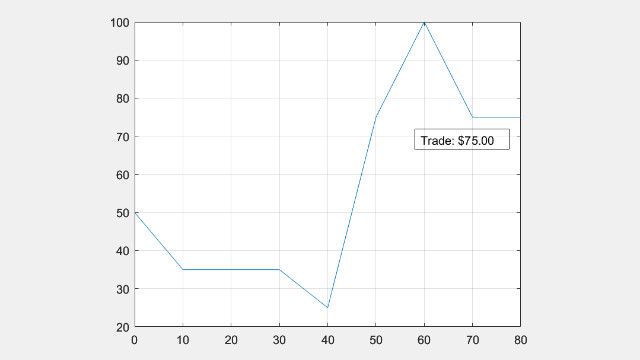

You can use the streaming and event-based data in MATLAB to build automated trading strategies that react to market events via industry-standard or proprietary trade execution platforms. The toolbox includes functions for analyzing transaction costs, accessing trade and quote pricing data, defining order types, and executing orders.

Supported data providers include Bloomberg®, FRED®, Haver Analytics®, Quandl®, and Refinitiv™. Supported trade execution platforms include Bloomberg EMSX, Trading Technologies® X_TRADER®, Wind Data Feed Services (WDS), and CQG®.

Supported Data Service Providers

Access market data and a variety of alternative data sources used in financial analysis.

Supported Trading Systems

Data

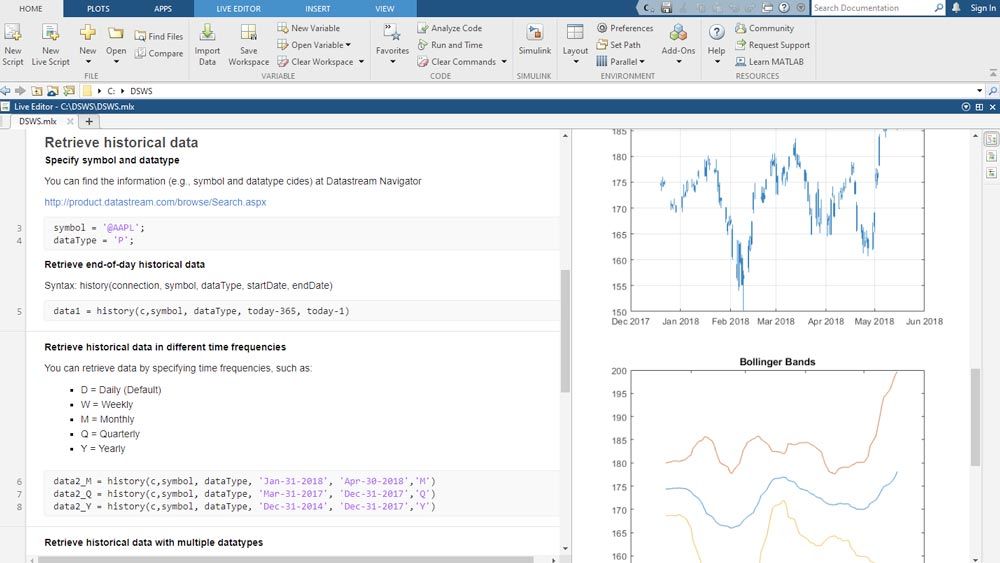

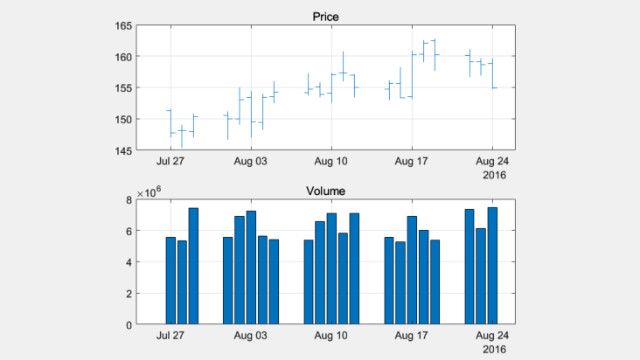

Current and Historical Data

Retrieve current or historical data using MATLAB functions such as fetch, getdata, history, or timeseries, which retrieve data immediately and do not update with changing market conditions. The data retrieved will vary by data service provider.

Real-Time Data

Retrieve dynamic data, such as event-based or streaming data, using the realtime function or by creating an event handler function in MATLAB that is executed each time new data is received from the service provider.

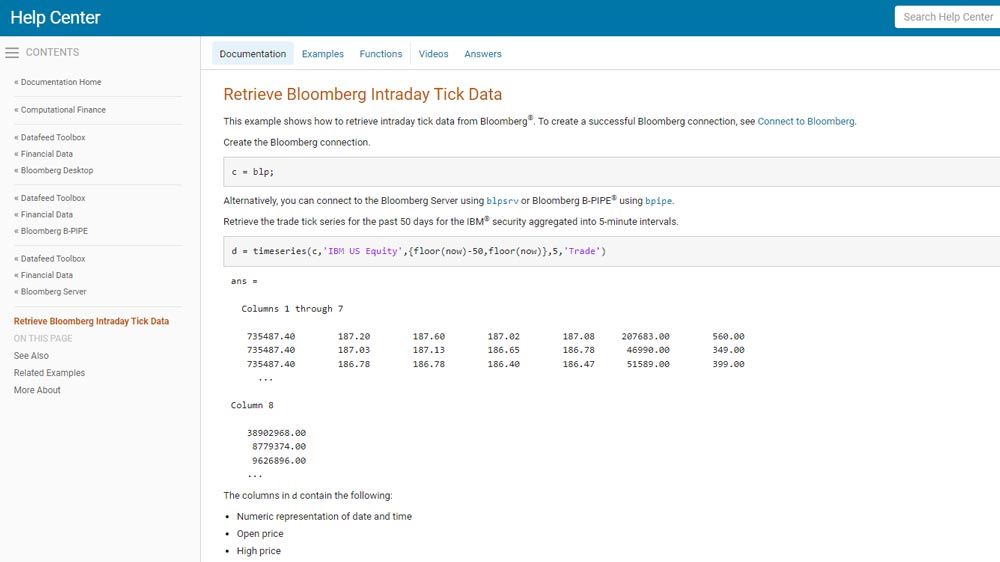

Intraday Tick Data

Use built-in functions to import intraday data into MATLAB. The amount of intraday data that can be imported varies by data service provider.

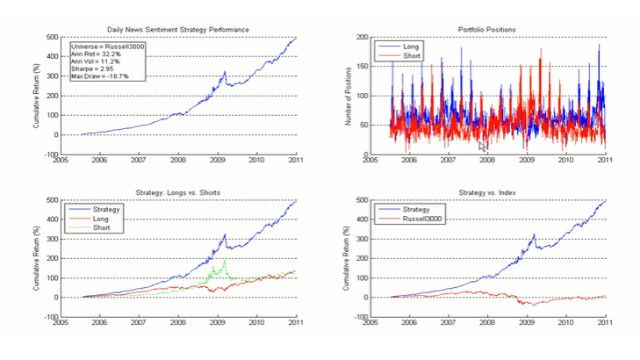

News Data

Retrieve large amounts of machine-readable news from Refinitiv or Bloomberg. Import the news data directly into MATLAB for sentiment analysis using Text Analytics Toolbox or by writing your own scripts.

Supported Trading Systems

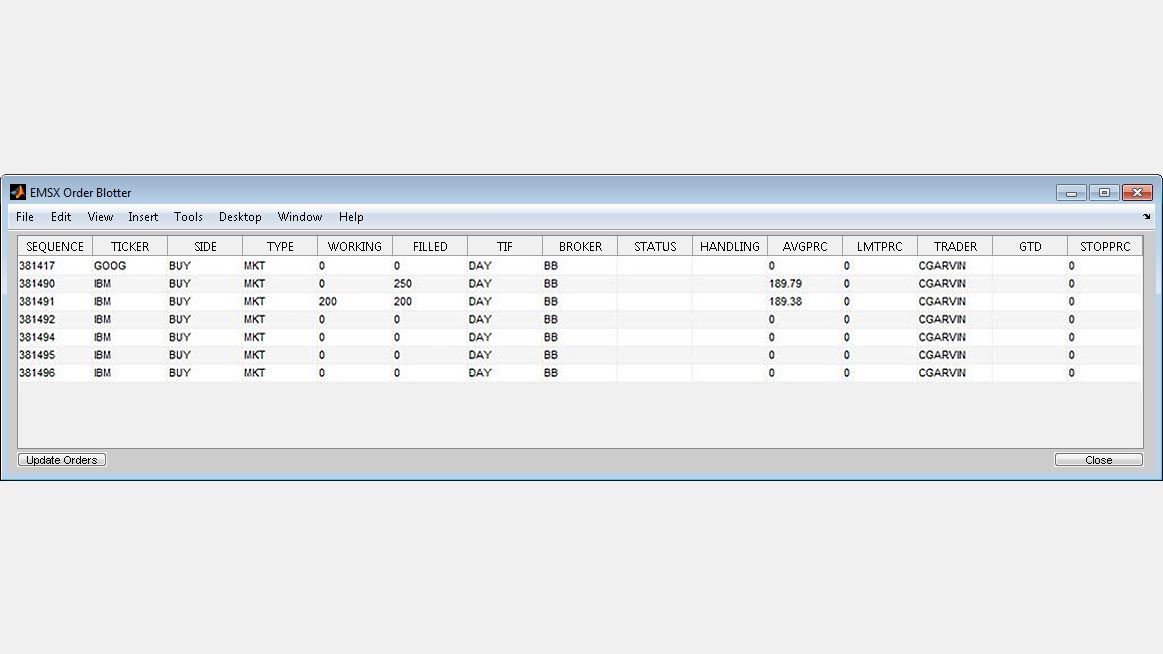

Bloomberg EMSX

With your Bloomberg EMSX license, you can connect to Bloomberg EMSX test and production servers to create, route, and manage orders. Retrieve real-time and event-based tradable instrument data from Bloomberg.

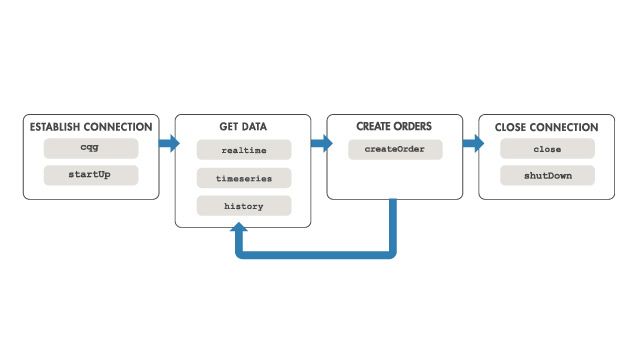

CQG

With your CQG license, you can connect to CQG to retrieve market data, execute trades, and track executed orders for multiple strategies.

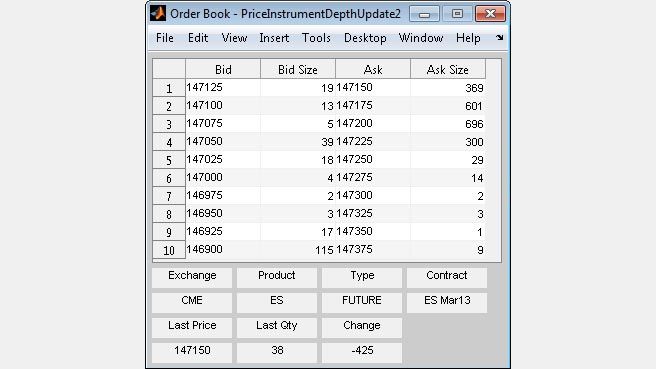

Trading Technologies X_Trader

With your X_TRADER license, you can retrieve real-time and event-based tradable instrument data, track changes in Level II market information, and submit orders and track execution.

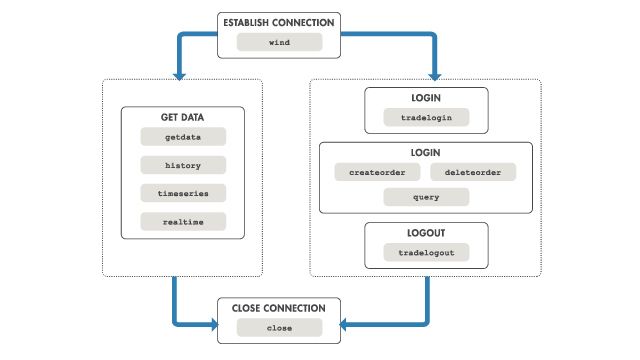

Wind Data Feed Services

With your access to Wind Data Feed Services or Wind Financial Terminal, you can retrieve market data, perform trade execution, and track executed orders.

Product Resources:

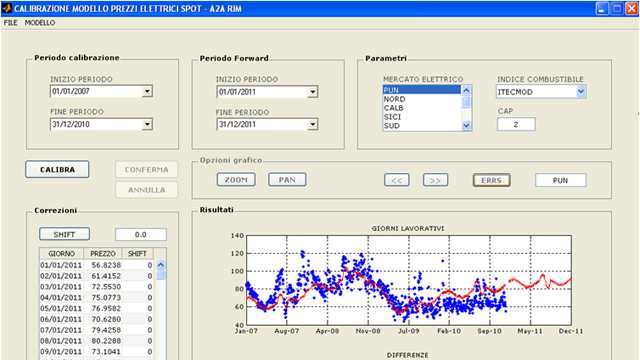

“When you deal with numbers all day and work with sophisticated analytical models, having an integrated environment is invaluable. With MATLAB we visualize data, conduct back-testing, and plot graphs to see the results of changes we make, all in one environment, and that saves time.”

Simone Visonà, A2A

Get a Free Trial

30 days of exploration at your fingertips.

Ready to Buy?

Get pricing information and explore related products.

Are You a Student?

Your school may already provide access to MATLAB, Simulink, and add-on products through a campus-wide license.