Fully Flexible Views and Stress-testing

Version 1.6.0.0 (13.8 MB) by

Attilio Meucci

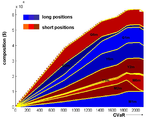

Full generalization of Black-Litterman and related techniques via entropy pooling

To walk through the code and for a thorough description, refer to

A. Meucci, "Fully Flexible Views: Theory and Practice"

Latest version of article and code available at http://symmys.com/node/158

Cite As

Attilio Meucci (2024). Fully Flexible Views and Stress-testing (https://www.mathworks.com/matlabcentral/fileexchange/21307-fully-flexible-views-and-stress-testing), MATLAB Central File Exchange. Retrieved .

MATLAB Release Compatibility

Created with

R2006b

Compatible with any release

Platform Compatibility

Windows macOS LinuxCategories

Find more on Optimization Toolbox in Help Center and MATLAB Answers

Tags

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Discover Live Editor

Create scripts with code, output, and formatted text in a single executable document.