Energy Trading & Risk Management with MATLAB Webinar Case Study

Version 1.4.0.1 (3.07 MB) by

Siddharth Sundar

MATLAB code for the generation asset risk analysis case study

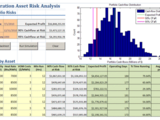

The case study presented here demonstrates using MATLAB to build an application for measuring the risks associated with a portfolio of gas-fired power plants operated in New England. The application has an interface implemented in Excel with all of the analytics performed by MATLAB. The application allows the user to specify the characteristics of the 7 plants including the capacity, heat rate, variable operation and maintenance costs and minimum run time. This portfolio can be backtested using a simple dispatch strategy on historical gas and electricity prices to compute historical profit and plant operation statistics. The risk measures are computed by simulating gas and electricity prices into the future using a hybrid model implemented in MATLAB, simulating the dispatch for each scenario of market prices and computing cash-flows arising from the operation of the plants. The distribution of the cash-flows is analyzed to produce a 90% and 95% cash-flow at risk measure for each plant as well as for the portfolio of generation assets. All of this functionality is presented with a succinct Excel front end.

The document titled "Introduction to ETRM Case Study" will guide you through the different components of the analysis.

Note: The data used in this application is not provided with the MATLAB Central File Exchange entry. The data can be obtained from the New England ISO at http://www.iso-ne.com/. The Natural Gas spot price data can be obtained from the Wall Street Journal at https://www.wsj.com. You can still view the results of running each script on the data by viewing the MATLAB-published reports included in the archive and also linked below.

Cite As

Siddharth Sundar (2026). Energy Trading & Risk Management with MATLAB Webinar Case Study (https://www.mathworks.com/matlabcentral/fileexchange/28056-energy-trading-risk-management-with-matlab-webinar-case-study), MATLAB Central File Exchange. Retrieved .

MATLAB Release Compatibility

Created with

R2010a

Compatible with any release

Platform Compatibility

Windows macOS LinuxCategories

- Industries > Energy Production > Oil, Gas & Petrochemical >

- Computational Finance > Financial Instruments Toolbox > Price Instruments Using Functions > Energy Derivatives >

- Computational Finance > Datafeed Toolbox > Financial Data > Transaction Cost Analysis >

Find more on Oil, Gas & Petrochemical in Help Center and MATLAB Answers

Tags

Acknowledgements

Inspired by: Intelligent Dynamic Date Ticks

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Discover Live Editor

Create scripts with code, output, and formatted text in a single executable document.