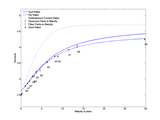

Estimation of Nelson-Siegel and Svensson Models

A robust and universal algorithm:

1. "Multistart" method to find the best fit

2. Possible to include LIBOR type rates.

3. Weighted price or yield-to-maturity minimization.

4. Calculates a variaety of error measures.

More details: Kladivko Kamil (2010). The Czech Treasury Yield Curve from 1999 to the Present, Czech Journal of Economics and Finance, 60(4): 307-335

Cite As

Kamil Kladivko (2024). Estimation of Nelson-Siegel and Svensson Models (https://www.mathworks.com/matlabcentral/fileexchange/37301-estimation-of-nelson-siegel-and-svensson-models), MATLAB Central File Exchange. Retrieved .

MATLAB Release Compatibility

Platform Compatibility

Windows macOS LinuxCategories

- Computational Finance > Financial Toolbox > Price and Analyze Financial Instruments >

- Computational Finance > Financial Instruments Toolbox > Price Instruments Using Functions > Yield Curves >

- Computational Finance > Financial Instruments Toolbox > Price Instruments Using Functions > Interest-Rate Instruments >

Tags

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Discover Live Editor

Create scripts with code, output, and formatted text in a single executable document.

fnc/

| Version | Published | Release Notes | |

|---|---|---|---|

| 1.0.0.0 |