Automated Trading with MATLAB - 2012

Files used in the webinar - Automated Trading with MATLAB broadcast on August 21, 2012. This webinar can be viewed at www.mathworks.com/videos/automated-trading-with-matlab-81911.html

Specific topics include:

* Data gathering options, including daily historic, intraday, and real-time data

* Model building and prototyping in MATLAB

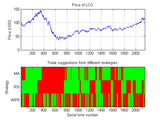

* Backtesting and calibrating a model

* Interacting with existing libraries and software for trade execution (X_Trader, QuickFIX/J, messaging queues)

It is recommended that you watch the webinar to see the "live" system running.

Cite As

Stuart Kozola (2024). Automated Trading with MATLAB - 2012 (https://www.mathworks.com/matlabcentral/fileexchange/37932-automated-trading-with-matlab-2012), MATLAB Central File Exchange. Retrieved .

MATLAB Release Compatibility

Platform Compatibility

Windows macOS LinuxCategories

- Computational Finance > Datafeed Toolbox > Financial Data >

- Computational Finance > Datafeed Toolbox > Financial Data > Trading Technologies >

- Computational Finance > Datafeed Toolbox > Financial Data > Transaction Cost Analysis >

Tags

Acknowledgements

Inspired by: Algorithmic Trading with MATLAB - 2010

Inspired: Commodities Trading with MATLAB, Algorithmic Trading with Bloomberg EMSX and MATLAB, Automated Trading System Development with MATLAB

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Discover Live Editor

Create scripts with code, output, and formatted text in a single executable document.