Stochastic State-Space Modeling of Financial Time-Series Data

Learn how State-Space representation of time-series may be used to model stochastic processes. Through an example application, MathWorks engineers will show you how state-space models can be defined, calibrated, estimated, and used to forecast time-series data sets. In particular, we will estimate the parameters of the popular Diebold-Li term structure model, as well as infer the unobserved factors of the model. Additionally, the forecast performance of the term structure model derived from the State-Space approach is compared to that of the more traditional 2-step approach using least squares and vector autoregressions.

Highlights Include

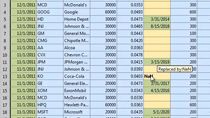

- Econometrics Toolbox overview

- State-space modeling

- Diebold-Li term structure

About the Presenter

Richard Baker is a Consultant Engineer, and has been working with financial clients worldwide and directly supporting the Computational Finance group of MathWorks for almost 18 years. His background is originally in physics and signal processing, followed by a graduate degree in business administration with a concentration in finance and economics. He is the original author of the Econometrics Toolbox, and also a contributor to the Financial Toolbox. His current development projects include Monte Carlo simulation of stochastic differential equations, as well as estimation, simulation, and forecasting of various time series models.

Recorded: 5 Aug 2014