American Option pricing with Bayesian Monte Carlo Path

Multipath computation of American option prices and confidence limits based on statistics

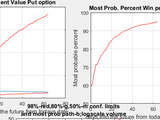

A probability distribution is calculated from a past stock chart and the fat tails are estimated. The distribution , unique to every stock chart, is used to generate an arbitrary number of paths into the future (3000 by default) and 50% and 80% and 98% confidence intervals are calculated and displayed. A computation of the most probable call to put ratio is calculated and used to generate a Most Probable Win percentage per day. The final absolute probability of winning at the 98% level is used to calculate the Kelly Criterion multiplied by 0.92 in the Risk Analysis section of the figure. This simulation differs significantly from Black Scholes and is more accurate. Every stock has its own probability distribution in the past. Care should be taken to note that market conditions can change abruptly in the future and distributions can be significantly altered over a short time frame by global market events, Intra-day distributions can be remarkably different from end of day distributions, so the results may vary from real world trading but it is probably the most accurate look ahead in stable markets that we are going to get with a mathematical approach. Care and attention to liquidity , volume and volatility should be observed.

Stock Forecasting and American Option pricing compared to Black- Scholes(BS) using Bayesian Markov Monte Carlo Simulation and Wavelet or Fourier or Neural Network Extrapolation with Indicators..http://library.wolfram.com/infocenter/MathSource/9086/ for more information!

If you use the alternate program as well, Bayesian Markov Stochastic Monte Carlo Valuation of Integrated Price Volume Action with Kelly Criterion, the kelly values from that program should be more accurate as an assessment of volume trends are also incorporated and we all know how important liquidity is. An expert using both programs will be a better judge just before an earnings announcement. A Fourier extrapolation is also carried out, but is only valid if it is supported in the range by the Statistical look ahead! The extrapolation is important for assessment of trends and cycles!

Cite As

Chondrally (2025). American Option pricing with Bayesian Monte Carlo Path (https://www.mathworks.com/matlabcentral/fileexchange/56352-american-option-pricing-with-bayesian-monte-carlo-path), MATLAB Central File Exchange. Retrieved .

MATLAB Release Compatibility

Platform Compatibility

Windows macOS LinuxCategories

- AI and Statistics > Curve Fitting Toolbox > Fit Postprocessing >

- Computational Finance > Financial Toolbox > Price and Analyze Financial Instruments >

- Computational Finance > Financial Toolbox > Stochastic Differential Equation (SDE) Models >

Tags

Acknowledgements

Inspired: Bayesian Monte Carlo Valuation of Price Volume Action

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Discover Live Editor

Create scripts with code, output, and formatted text in a single executable document.

| Version | Published | Release Notes | |

|---|---|---|---|

| 29.0.0.1 | Updated to reflect correct Toolbox dependencies |

||

| 29.0.0.0 | changed title |

||

| 28.0.0.0 | updated coeffs in generateTemperatures, to reflect proper linear trend into future

|

||

| 27.0.0.0 | updated description

|

||

| 26.0.0.0 | updated tiltle to include Density functional , i use a probabilty density functional to compute the path integral |

||

| 25.0.0.0 | updated expiration date |

||

| 24.0.0.0 | updated all kelly criterion formulas with error checking |

||

| 23.0.0.0 | updated musicfinal

|

||

| 22.0.0.0 | added two profit graphs, one for most probable profit and one for fourier path profit

|

||

| 21.0.0.0 | updated optionprices, musicfinal and kelly criterion calculation included plot of fourier fit to data |

||

| 20.0.0.0 | updated musicfinal and added getpercenterrorlinear3 to fix scaling of fourier output |

||

| 19.0.0.0 | updated kelly criterion and figure

|

||

| 18.0.0.0 | added one last line to MusicFinal y = y - y(N2)+s0 to fix discontinuity at boundary |

||

| 17.0.0.0 | u[pdated MusicFinal to fix discontinuity at boundary condition

|

||

| 16.0.0.0 | updated title

|

||

| 15.0.0.0 | introduced MUSICFINAL subroutine and corrected fourier trend analysis |

||

| 14.0.0.0 | fixed volatility presentation and updated figure display |

||

| 13.0.0.0 | updated color of calculate plots button to make it more noticeable

|

||

| 12.0.0.0 | changed default number of paths to 3000 |

||

| 11.0.0.0 | updated kelly call and kelly put criterion |

||

| 10.0.0.0 | updated figure |

||

| 9.0.0.0 | added edit box to figure and matlab code to calculate the ratio of EMA 40 days to EMA 200 days, a critical ratio for trading. |

||

| 8.0.0.0 | updated magnitude calculation of spectral components

|

||

| 7.0.0.0 | corrected magnitude of spectral components in rootmusic fourier so that amplitudes of black time series would be commensurate with data spectral components. |

||

| 5.0.0.0 | added phase to rootmusic fourier so that timing of trend in stock chart will continue appropriately |

||

| 4.0.0.0 | forgot to add new zip file last time, updated black rootmusic fourier mag and phase

|

||

| 3.0.0.0 | updated documentation

|

||

| 2.0.0.0 | Changed way risk analysis is reported to make it more intuitive |

||

| 1.0.0.0 | included a more realistic description of real markets

got rid of unnecessary required toolboxes |