floatbyzero

Price floating-rate note from set of zero curves

Syntax

Description

[ prices

a floating-rate note from a set of zero curves.Price,DirtyPrice,CFlowAmounts,CFlowDates]

= floatbyzero(RateSpec,Spread,Settle,Maturity)

floatbyzero computes prices of vanilla floating-rate

notes and amortizing floating-rate notes.

Note

Alternatively, you can use the FloatBond object to

price floating-rate bond instruments. For more information, see Get Started with Workflows Using Object-Based Framework for Pricing Financial Instruments.

[ adds

additional name-value pair arguments.Price,DirtyPrice,CFlowAmounts,CFlowDates]

= floatbyzero(___,Name,Value)

Examples

Price a 20-basis point floating-rate note using a set of zero curves.

Load deriv.mat, which provides ZeroRateSpec, the interest-rate term structure, needed to price the bond.

load deriv.mat;Define the floating-rate note using the required arguments. Other arguments use defaults.

Spread = 20; Settle = datetime(2000,1,1); Maturity = datetime(2003,1,1);

Use floatbyzero to compute the price of the note.

Price = floatbyzero(ZeroRateSpec, Spread, Settle, Maturity)

Price = 100.5529

Price an amortizing floating-rate note using the Principal input argument to define the amortization schedule.

Create the RateSpec.

Rates = [0.03583; 0.042147; 0.047345; 0.052707; 0.054302]; ValuationDate = datetime(2011,11,15); StartDates = ValuationDate; EndDates = [datetime(2012,11,15) ; datetime(2013,11,15) ; datetime(2014,11,15) ; datetime(2015,11,15) ; datetime(2016,11,15)]; Compounding = 1; RateSpec = intenvset('ValuationDate', ValuationDate,'StartDates', StartDates,... 'EndDates', EndDates,'Rates', Rates, 'Compounding', Compounding)

RateSpec = struct with fields:

FinObj: 'RateSpec'

Compounding: 1

Disc: [5×1 double]

Rates: [5×1 double]

EndTimes: [5×1 double]

StartTimes: [5×1 double]

EndDates: [5×1 double]

StartDates: 734822

ValuationDate: 734822

Basis: 0

EndMonthRule: 1

Create the floating-rate instrument using the following data:

Settle = datetime(2011,11,15); Maturity = datetime(2015,11,15); Spread = 15;

Define the floating-rate note amortizing schedule.

Principal ={{datetime(2012,11,15) 100;datetime(2013,11,15) 70;datetime(2014,11,15) 40;datetime(2015,11,15) 10}};Compute the price of the amortizing floating-rate note.

Price = floatbyzero(RateSpec, Spread, Settle, Maturity, 'Principal', Principal)Price = 100.3059

If Settle is not on a reset date of a floating-rate note,

floatbyzero attempts to obtain the latest floating rate before

Settle from RateSpec or the

LatestFloatingRate parameter. When the reset date for this rate is

out of the range of RateSpec (and LatestFloatingRate

is not specified), floatbyzero fails to obtain the rate for that date

and generates an error. This example shows how to use the

LatestFloatingRate input parameter to avoid the error.

Create the error condition when a floating-rate instrument’s StartDate cannot

be determined from the RateSpec.

load deriv.mat;

Spread = 20;

Settle = datetime(2000,1,1);

Maturity = datetime(2003,12,1);

Price = floatbyzero(ZeroRateSpec, Spread, Settle, Maturity)Error using floatbyzero (line 256) The rate at the instrument starting date cannot be obtained from RateSpec. Its reset date (01-Dec-1999) is out of the range of dates contained in RateSpec. This rate is required to calculate cash flows at the instrument starting date. Consider specifying this rate with the 'LatestFloatingRate' input parameter.

Here, the reset date for the rate at Settle was

01-Dec-1999, which was earlier than the valuation date of ZeroRateSpec (01-Jan-2000).

This error can be avoided by specifying the rate at the instrument’s

starting date using the LatestFloatingRate name-value

pair argument.

Define LatestFloatingRate and calculate

the floating-rate price.

Price = floatbyzero(ZeroRateSpec, Spread, Settle, Maturity, 'LatestFloatingRate', 0.03)Price = 100.0285

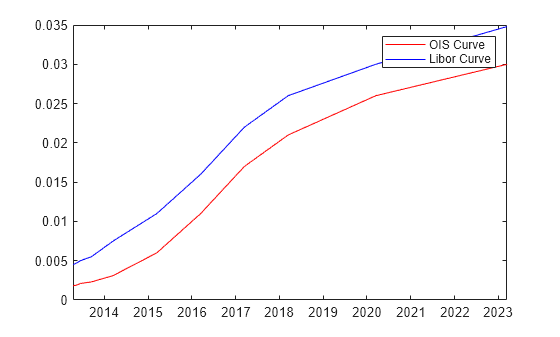

Define the OIS and Libor rates.

Settle = datetime(2013,3,15); CurveDates = daysadd(Settle,360*[1/12 2/12 3/12 6/12 1 2 3 4 5 7 10],1); OISRates = [.0018 .0019 .0021 .0023 .0031 .006 .011 .017 .021 .026 .03]'; LiborRates = [.0045 .0047 .005 .0055 .0075 .011 .016 .022 .026 .030 .0348]';

Plot the dual curves.

figure,plot(CurveDates,OISRates,'r');hold on;plot(CurveDates,LiborRates,'b') legend({'OIS Curve', 'Libor Curve'})

Create an associated RateSpec for the OIS and Libor curves.

OISCurve = intenvset('Rates',OISRates,'StartDate',Settle,'EndDates',CurveDates); LiborCurve = intenvset('Rates',LiborRates,'StartDate',Settle,'EndDates',CurveDates);

Define the floating-rate note.

Maturity = datetime(2018,3,15);

Compute the price for the floating-rate note. The LiborCurve term structure will be used to generate the floating cash flows of the floater instrument. The OISCurve term structure will be used for discounting the cash flows.

Price = floatbyzero(OISCurve,0,Settle,Maturity,'ProjectionCurve',LiborCurve)Price = 102.4214

Some instruments require using different interest-rate curves for generating the floating cash flows and discounting. This is when the ProjectionCurve parameter is useful. When you provide both RateSpec and ProjectionCurve, floatbyzero uses the RateSpec for the purpose of discounting and it uses the ProjectionCurve for generating the floating cash flows.

Input Arguments

Annualized zero rate term structure, specified using intenvset to create a RateSpec.

Data Types: struct

Number of basis points over the reference rate, specified as

a NINST-by-1 vector.

Data Types: double

Settlement date, specified either as a scalar or

NINST-by-1 vector using a datetime array, string

array, or date character vectors.

To support existing code, floatbyzero also

accepts serial date numbers as inputs, but they are not recommended.

Settle must be earlier than Maturity.

Maturity date, specified as a NINST-by-1 vector using a

datetime array, string array, or date character vectors representing the maturity date

for each floating-rate note.

To support existing code, floatbyzero also

accepts serial date numbers as inputs, but they are not recommended.

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: [Price,DirtyPrice,CFlowAmounts,CFlowDates]

= floatbyzero(RateSpec,Spread,Settle,Maturity,'Principal',Principal)

Frequency of payments per year, specified as the comma-separated pair consisting

of 'FloatReset' and a

NINST-by-1 vector.

Data Types: double

Day count basis, specified as the comma-separated pair consisting of

'Basis' and a NINST-by-1

vector.

0 = actual/actual

1 = 30/360 (SIA)

2 = actual/360

3 = actual/365

4 = 30/360 (PSA)

5 = 30/360 (ISDA)

6 = 30/360 (European)

7 = actual/365 (Japanese)

8 = actual/actual (ICMA)

9 = actual/360 (ICMA)

10 = actual/365 (ICMA)

11 = 30/360E (ICMA)

12 = actual/365 (ISDA)

13 = BUS/252

For more information, see Basis.

Data Types: double

Notional principal amounts, specified as the comma-separated pair consisting of

'Principal' and a vector or cell array.

Principal accepts a NINST-by-1 vector

or NINST-by-1 cell array, where

each element of the cell array is a NumDates-by-2 cell

array and the first column is dates and the second column is its associated

notional principal value. The date indicates the last day that the

principal value is valid.

Data Types: cell | double

End-of-month rule flag for generating dates when Maturity is an

end-of-month date for a month having 30 or fewer days, specified as the

comma-separated pair consisting of 'EndMonthRule' and a nonnegative

integer [0, 1] using a

NINST-by-1 vector.

0= Ignore rule, meaning that a payment date is always the same numerical day of the month.1= Set rule on, meaning that a payment date is always the last actual day of the month.

Data Types: logical

Rate for the next floating payment set at the last reset date, specified as the

comma-separated pair consisting of 'LatestFloatingRate' and a

NINST-by-1.

The LatestFloatingRate is specified as the benchmark plus the

spread (for example, SOFR + spread).

Data Types: double

The rate curve to be used in generating the future forward rates, specified as the

comma-separated pair consisting of 'ProjectionCurve' and a

structure created using intenvset. Use this optional input

if the forward curve is different from the discount curve.

Data Types: struct

Flag to adjust cash flows based on actual period day count, specified as the comma-separated

pair consisting of 'AdjustCashFlowsBasis' and a

NINST-by-1 vector of logicals with values of

0 (false) or 1 (true).

Data Types: logical

Holidays used in computing business days, specified as the comma-separated pair consisting of

'Holidays' and MATLAB dates using a NHolidays-by-1

vector.

Data Types: datetime

Business day conventions, specified as the comma-separated pair consisting of

'BusinessDayConvention' and a character vector or a

N-by-1 cell array of character vectors of

business day conventions. The selection for business day convention determines how

non-business days are treated. Non-business days are defined as weekends plus any

other date that businesses are not open (e.g. statutory holidays). Values are:

actual— Non-business days are effectively ignored. Cash flows that fall on non-business days are assumed to be distributed on the actual date.follow— Cash flows that fall on a non-business day are assumed to be distributed on the following business day.modifiedfollow— Cash flows that fall on a non-business day are assumed to be distributed on the following business day. However if the following business day is in a different month, the previous business day is adopted instead.previous— Cash flows that fall on a non-business day are assumed to be distributed on the previous business day.modifiedprevious— Cash flows that fall on a non-business day are assumed to be distributed on the previous business day. However if the previous business day is in a different month, the following business day is adopted instead.

Data Types: char | cell

Output Arguments

Floating-rate note prices, returned as a (NINST)

by number of curves (NUMCURVES) matrix. Each column

arises from one of the zero curves.

Dirty note price (clean + accrued interest), returned as a NINST-

by-NUMCURVES matrix. Each column arises from one

of the zero curves.

Cash flow amounts, returned as a NINST- by-NUMCFS matrix

of cash flows for each note. If there is more than one curve specified

in the RateSpec input, then the first NCURVES rows

correspond to the first note, the second NCURVES rows

correspond to the second note, and so on.

Cash flow dates, returned as a NINST- by-NUMCFS matrix

of payment dates for each note.

More About

A floating-rate note is a security like a bond, but the interest rate of the note is reset periodically, relative to a reference index rate, to reflect fluctuations in market interest rates.

Version History

Introduced before R2006aAlthough floatbyzero supports serial date numbers,

datetime values are recommended instead. The

datetime data type provides flexible date and time

formats, storage out to nanosecond precision, and properties to account for time

zones and daylight saving time.

To convert serial date numbers or text to datetime values, use the datetime function. For example:

t = datetime(738427.656845093,"ConvertFrom","datenum"); y = year(t)

y =

2021

There are no plans to remove support for serial date number inputs.

See Also

bondbyzero | cfbyzero | fixedbyzero | swapbyzero | intenvset | FloatBond

Topics

- Pricing Using Interest-Rate Term Structure

- Price Portfolio of Bond and Bond Option Instruments

- Compute LIBOR Fallback

- Floating-Rate Note

- Understanding Interest-Rate Tree Models

- Supported Interest-Rate Instrument Functions

- Mapping Financial Instruments Toolbox Functions for Interest-Rate Instrument Objects

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)